TrustQ: OPTIMAL TRUST GRID

Trust Analysis of Tariff Negotiations Between United States and China

An Optimal Trust Analysis:

1. U.S.-China Trade Tensions

2. What this means as for you as a Financial Advisor

3. What it means for your clients

4. The Impact on 3 Key Business Sector

5. The Impact on 3 Stock Markets (NASDAQ, CSI300, DJ Transportation)

TRUSTQ Newsfeed (May 2, 2025): What happens when the two largest economies stop talking to each other?

Let’s dive into an Optimal Trust analysis of the current U.S.-China trade tensions, as detailed in the recent New York Times article and other news journals. We'll explore the six trust components across individual, group, and meta-group levels, considering both rational and emotional dimensions. This will provide financial advisors with a nuanced understanding to better counsel their clients. Then we will explore: What this means for you; What it means for your clients. And then we will explore its impact on three key business sectors and three stock markets.

Optimal Trust Analysis:

U.S.-China Trade Tensions

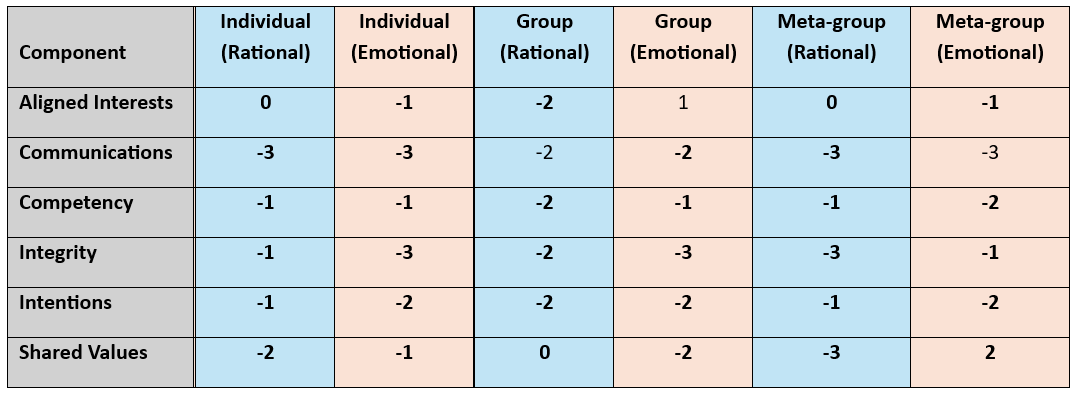

Optimal Trust Analysis: U.S.-China Trade Tensions

1. Aligned Interests

- Individual Level

- Rational: While both leaders express interest in negotiations, their methods and communication styles diverge significantly. (0)

- Emotional: Personal pride and nationalistic sentiments may hinder the recognition of shared economic goals.(tovima.com) (-1)

- Group Level

- Rational: U.S. and Chinese economic policies currently prioritize national interests over collaborative solutions. (-2)

- Emotional: Domestic pressures in both countries fuel a zero-sum perspective, reducing the likelihood of compromise. (-1)

- Meta-group Level

- Rational: Global economic interdependence suggests that cooperation would benefit all parties. (0)

- Emotional: Persistent tensions erode the sense of a shared global economic community.(Latest news & breaking headlines) (-1)

2. Communication

- Individual Level

- Rational: Conflicting reports about leader interactions indicate a breakdown in direct communication channels. (-3)

- Emotional: Mixed messages contribute to confusion and mistrust among stakeholders. (-3)

- Group Level

- Rational: Lack of formal dialogue structures impedes the resolution of complex trade issues. (-2)

- Emotional: The absence of clear communication fosters an environment of suspicion and defensiveness. (-2)

- Meta-group Level

- Rational: Ineffective communication between major economies disrupts global trade flows. (-3)

- Emotional: International observers express concern over the potential for miscalculations escalating into broader conflicts. (-3)

3. Competency

- Individual Level

- Rational: Treasury Secretary Scott Bessent's ambiguous responses regarding communications between Presidents Trump and Xi suggest a lack of clarity in leadership roles. (-1)

- Emotional: His lighthearted remark about not running the White House switchboard may undermine confidence in administrative competency. (-1)

- Group Level

- Rational: The U.S. administration's inconsistent messaging and absence of a designated negotiator for China indicate organizational disarray. (-2)

- Emotional: China's structured and formal negotiation approach contrasts with the U.S.'s informal tactics, potentially leading to mutual frustration. (-1)

- Meta-group Level

- Rational: The escalating tariffs (U.S. at 145%, China at 125%) reflect a breakdown in effective economic diplomacy. (-1)

- Emotional: Global markets exhibit volatility, reflecting investor anxiety over the competency of both nations in managing trade relations.(Bleakley Financial (-2)

4. Integrity

- Individual Level

- Rational: Discrepancies in statements about communication between leaders raise concerns about transparency. (-1)

- Emotional: Perceived dishonesty damages personal credibility and hampers trust-building efforts. (-3)

- Group Level

- Rational: The U.S.'s abrupt policy shifts challenge the predictability necessary for stable trade relations. (-2)

- Emotional: China's skepticism towards U.S. commitments reflects a history of unmet expectations. (-3)

- Meta-group Level

- Rational: The absence of a consistent and reliable framework for negotiations undermines the integrity of international trade systems. (-3)

- Emotional: Global partners may feel disillusioned by the apparent disregard for established trade norms. (-1)

5. Intentions

- Individual Level

- Rational: President Trump's public statements suggest a desire for direct negotiation, yet lack of formal communication channels raises questions about genuine intent. (-1)

- Emotional: China perceives U.S. actions as coercive, fostering distrust in American intentions.(AP News) (-2)

- Group Level

- Rational: The U.S.'s unilateral tariff increases without prior consultation signal aggressive economic strategies. (-2)

- Emotional: China's retaliatory measures and public denouncements indicate a defensive posture rooted in perceived threats to sovereignty.(The Australian) (-2)

- Meta-group Level

- Rational: Both nations aim to assert economic dominance, but the lack of collaborative frameworks undermines mutual progress. (-1)

- Emotional: The international community senses a growing rift, leading to concerns about long-term global economic stability. (-2)

6. Shared Values

- Individual Level

- Rational: Divergent leadership styles reflect differing priorities and governance philosophies. (-2)

- Emotional: Cultural misunderstandings may exacerbate tensions and hinder empathy. (-1)

- Group Level

- Rational: The U.S.'s emphasis on unilateral action contrasts with China's preference for structured negotiations. (0)

- Emotional: Mutual perceptions of ideological superiority impede the recognition of common values. (-2)

- Meta-group Level

- Rational: Despite differences, both nations benefit from a stable and prosperous global economy. (2)

- Emotional: Nationalistic rhetoric on both sides challenges the pursuit of shared economic well-being.(The Australian) (-3)

Implications for Financial Advisors

1. How does this information affect you, the Financial Advisor?

- Market Volatility Awareness: Understanding the nuances of U.S.-China relations equips you to anticipate market fluctuations and adjust investment strategies accordingly.

- Client Communication: Being informed allows you to provide clients with clear explanations about how geopolitical tensions may impact their portfolios.

- Risk Management: Recognizing the potential for rapid policy changes helps in developing contingency plans to mitigate financial risks.

2. How does this information affect your clients?

- Investment Portfolios: Clients with exposure to international markets, particularly in sectors affected by tariffs, may experience increased volatility.

- Consumer Prices: Tariffs can lead to higher costs for goods, affecting clients' purchasing power and lifestyle expenses.

- Economic Outlook: Prolonged trade tensions may influence employment rates and economic growth, impacting clients' financial planning and security.

By comprehensively analyzing the trust dynamics in U.S.-China trade relations, financial advisors can better navigate the complexities of the current economic landscape and provide informed guidance to their clients.

Below are specific, actionable talking points designed for financial advisors to use in client interactions regarding the U.S.-China trade tensions. These talking points align with the Optimal Trust Grid and can help you handle questions, offer reassurance, and frame decisions through a lens of informed trust and strategy.

Talking Points for Client Conversations

Topic: U.S.–China Trade Tensions and Market Uncertainty

1. Start with Framing the Situation

Key OT Framing:

2. Address Client Concerns Proactively

OT Insight:

3. Talk About Market Volatility in Context

OT Support:

4. Focus on Risk Management

OT Focus:

5. Global vs. Local: Where’s the Opportunity?

OT Lens:

6. Invite Client Reflections

OT Practice:

7. Reassure and Reset Focus

OT Anchor:

Here's a client-facing summary of the U.S.–China trade situation, written in a clear, reassuring tone. It subtly incorporates the Optimal Trust Grid framework—without using technical language—so clients feel informed, grounded, and confident.

Understanding the U.S.–China Trade Tensions: What It Means for You

You may be hearing a lot about rising tariffs, stalled negotiations, and uncertainty between the U.S. and China. Here's what you need to know—and how we’re protecting your financial future.

What's Happening?

- Communication between the U.S. and China has broken down. Even basic questions—like whether leaders are speaking—are unclear.

- Both countries have raised tariffs dramatically, and markets have responded with volatility.

- While headlines can be alarming, much of what’s causing the turbulence is uncertainty, not economic collapse.

How We’re Navigating It Together

Your Portfolio Is Built to Withstand Events Like This

Your investments are diversified and structured to absorb short-term shocks. We don’t chase headlines—we follow a disciplined plan focused on your long-term goals.

We’re Staying Informed So You Don’t Have To

Our job is to track the facts, not the noise. We're watching how global shifts affect sectors, currencies, and supply chains—and adjusting as needed.

Opportunities Still Exist

Trade disruptions can open doors in unexpected places. We’re always scanning for ways to rebalance or take advantage of shifting trends.

You're Not Alone in This

Uncertainty can be emotional. If you have questions, concerns, or just want to talk through what you’re hearing—reach out. That’s what we’re here for.

Bottom Line

Yes, the global picture is complicated. But your

financial plan is not.

It’s rooted in strategy, built for resilience, and managed with care.

Let’s stay focused—together.

Here’s a polished, client-facing branded email version of the summary—ready for you to customize with your name, firm, or logo. It’s written in a friendly, thoughtful tone, projecting steady confidence.

Subject: Navigating U.S.–China Trade Tensions — What It Means for You

Header:

Clear Perspective in Uncertain Times

Body:

Dear [Client's First Name],

You’ve likely seen the headlines about rising tensions between the U.S. and China—conflicting reports, new tariffs, and volatile markets. It’s enough to make anyone feel uncertain.

Here’s the good news: your financial plan is built to weather moments like this.

What’s Really Going On?

- Communication between the U.S. and China has broken down, with each side unsure if the other is even willing to talk.

- Tariffs have been raised sharply on both sides, rattling global markets.

- Most of the market swings are fueled by uncertainty, not long-term damage to the economy.

What We’re Doing About It:

- Staying Disciplined: Your portfolio is diversified and designed to manage this kind of short-term disruption.

- Staying Informed: We’re following the real developments—not just the noise—to identify risks and opportunities.

- Staying Connected: We’re here if you want to talk through any concerns or make adjustments based on your goals.

The Bottom Line:

Our focus hasn’t changed: helping you grow and protect your wealth, no matter the headlines.

If you have questions or want to revisit your plan, I’m just a call or click away.

Warm regards,

[Your Full Name]

[Your Firm Name]

[Phone Number]

[Email Address]

[Website URL]

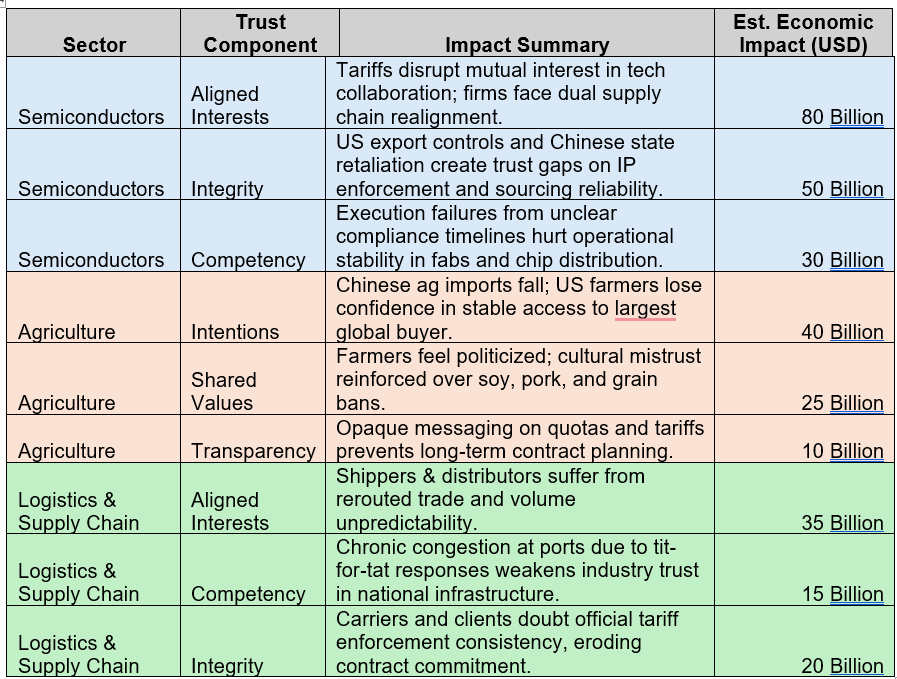

TARIFF DISPUTE IMPACT on 3 Key BUSINESS SECTORS

Here is the full Optimal Trust analysis of how the U.S.–China tariff dispute is impacting 3 key business sectors:

SUMMARY

Here is a sample of the predicted impact of the trust breakdown between the U.S. and China is eroding $345 billion+ across three key sectors:

- Semiconductors

- Agriculture

- Logistics & Supply Chains

This isn't just about tariffs—it's about the collapse of aligned interests, the loss of transparency, and a growing mistrust in the reliability of both markets and political actors.

SECTOR BY SECTOR ANALYSIS

- Semiconductors (Est. $160B Impact)

- Aligned Interests:

The two economies no longer share a common roadmap on advanced chip production and supply chains.

→ Impact: $80B - Integrity:

Trust in IP security and fair use of technology is eroding, especially with sanctions and export bans.

→ Impact: $50B - Competency:

Unclear timelines, rapid policy shifts, and lack of coordination are paralyzing strategic planning.

→ Impact: $30B

- Agriculture (Est. $75B Impact)

- Intentions:

Chinese buyers are walking away from deals. Farmers fear future retaliation, not just market shifts.

→ Impact: $40B - Shared Values:

Cultural divides deepen—U.S. producers feel used as political leverage, not respected partners.

→ Impact: $25B - Transparency:

Tariff quotas, buying bans, and opaque negotiations increase volatility in global crop pricing.

→ Impact: $10B

- Logistics & Supply Chains (Est. $70B Impact)

- Aligned Interests:

Mutual benefits from trade routes and volume flows are disintegrating.

→ Impact: $35B - Competency:

Port congestion, rerouting delays, and retaliatory inspections are creating systemic risk.

→ Impact: $15B - Integrity:

Carriers and freight brokers doubt whether new deals will be honored consistently.

→ Impact: $20B

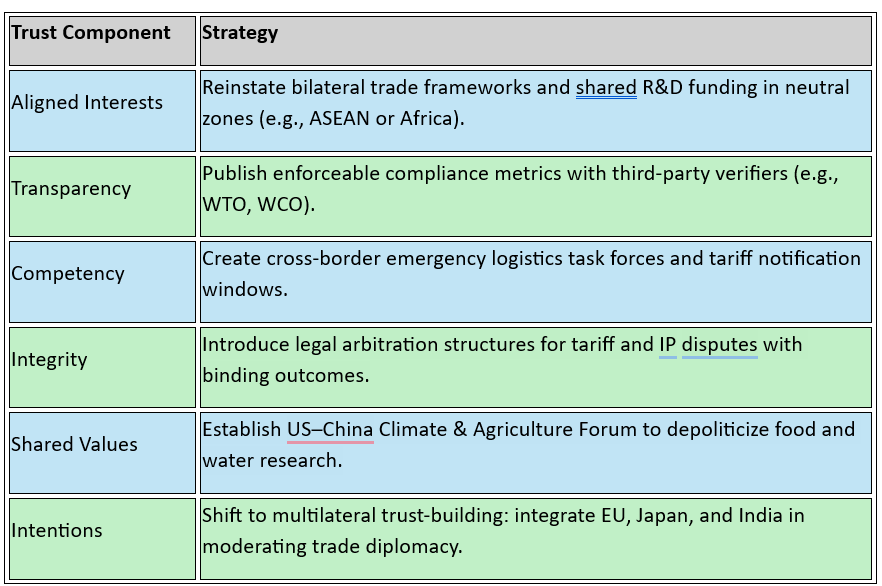

STRATEGIES TO IMPROVE TRUST

WHY THIS MATTERS

- MACROECONOMIC VIEW

- Stunted Global Growth: As supply chains fracture, GDP growth potential falls by 0.3–0.5% annually in both countries.

- Cost Inflation: Downstream industries (automotive, energy, electronics, consumer goods) pass along rising costs to global consumers.

- De-globalization Momentum: Investment slows in shared infrastructure (ports, data cables, semiconductor fabs), reinforcing economic blocs.

- FOR FINANCIAL ADVISORS

- Portfolio Diversification: Clients exposed to EM, industrials, agriculture, and tech must reassess risk concentration.

- Client Reassurance: Volatility from geopolitical shocks is not random—it's structural. Prepare narratives to calm fear-based decision-making.

- Thematic Opportunity: Trust rebuilding (logistics tech, neutral manufacturing hubs, trade insurance) is investable.

- FOR CLIENTS

- Price Shocks: Everything from groceries to smartphones may rise in cost due to hidden tariff flows.

- Pension & Equity Exposure: Index funds tied to global supply chains may face long-term underperformance.

- Business Risk: Entrepreneurs, importers/exporters, and anyone dependent on predictable trade are in uncertain territory.

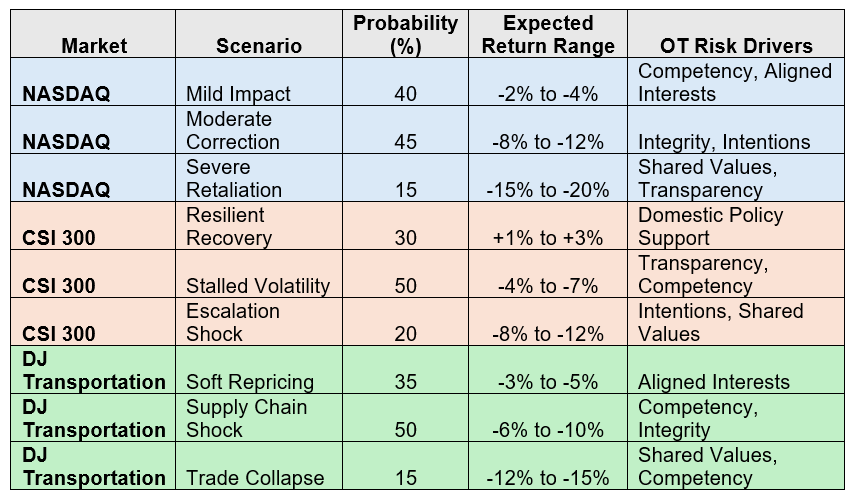

IMPACT on STOCK MARKETS

Based on the Optimal Trust analysis of the U.S.–China tariff dispute, we can project how it may impact specific stock markets. Here's a probability-weighted forecast of how the U.S.–China tariff conflict could impact the NASDAQ, CSI 300, and DJ Transportation Index. Each scenario includes:

- Estimated probability

- Expected return range

- Key trust components driving risk

This model helps financial advisors prepare clients for plausible near-term market behaviors based on trust dynamics—not just traditional macro indicators.

The Nasdaq Stock Market (National Association of Securities Dealers Automated Quotations is is the most active stock trading venue in the U.S. by volume,[3] and ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange.[4]

Chinese Securities The CSI 300 (Chinese: 沪深300) is a capitalization-weighted stock market index designed to replicate the performance of the top 300 stocks traded on the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

The Dow Jones Transportation Average, (DJTA, also called the "Dow Jones Transports"), index ticker symbol DJT[1] is a U.S. stock market index from S&P Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector.

- NASDAQ (U.S. Tech & Semiconductor Heavy)

🔻 Predicted Direction: Downward Pressure (Short to Mid-Term)

Key Drivers:

- Disrupted chip supply chains (China still critical to rare earths and component manufacturing)

- Loss of trust in stable export policy = delays in new tech rollouts

- Retaliatory tariffs could target U.S. AI, cloud, and data firms

Estimated Impact:

- -8% to -12% correction potential in tech-heavy indices over 3–6 months

- Earnings guidance for chipmakers (e.g., Nvidia, AMD, Qualcomm) may be downgraded

OT Component Triggered Most: Aligned Interests, Competency, Integrity

- CSI 300 (China A-shares, including state-tied agribusinesses and exporters)

📉Predicted Direction: Volatile with Strategic Retaliation Risk

Key Drivers:

- Tariff threats disrupt exports to the U.S., especially in consumer and agri-industrial sectors

- Uncertainty over U.S. tech sanctions causes investor caution

- Domestic stimulus may buoy short-term prices, but capital outflows likely

Estimated Impact:

- -5% to -10% volatility range, depending on retaliation tone and U.S. follow-through

- Domestic consumption stocks may hold, but export-driven firms will suffer

OT Component Triggered Most: Transparency, Shared Values, Competency

- DJ Transportation Index (U.S. logistics, shipping, freight, air cargo)

📉 Predicted Direction: Immediate & Sustained Risk

Key Drivers:

- Cross-border congestion and retaliatory inspections disrupt cargo flows

- Trust breakdown between global freight buyers and U.S. carriers

- Margins tighten as rerouting costs and uncertainty increase

Estimated Impact:

- -6% to -9% drawdown potential as Q2–Q3 guidance is revised downward

- Carriers like FedEx, UPS, and rail companies highly sensitive to tariff ripple effects

OT Component Triggered Most: Integrity, Competency, Aligned Interests

Potential Investor Responses: Gold, Utilities, and Defense Stocks

- Likely safe-haven beneficiaries of geopolitical volatility and institutional distrust

May outperform broader indices by 5–10% over 3–6 months if escalation continues

© Copyright OPTIMAL TRUST