Trust Q Analysis:

United States Attack on Venezuela

January 5, 2026

Beyond Regime Change: The Trust Breakdown Behind the U.S.–Venezuela Crisis

In early January 2026, the relationship between the United States and Venezuela entered uncharted territory. The Trump administration authorized an extraordinary operation that resulted in the capture of Venezuelan President Nicolás Maduro and his wife, immediately freezing Venezuelan oil exports and sending shockwaves through energy markets, emerging-market risk assets, and the diplomatic architecture of the Western Hemisphere. This is not a conventional regime-change headline or a simple oil story. It is a trust rupture across sovereignty, legitimacy, and rules of engagement—one that markets must now price in real time. What follows is a full Optimal Trust analysis designed to help financial advisors understand what is actually breaking, what may stabilize, and how to guide client conversations with clarity rather than reaction.

Advisory Note: This analysis is for informational purposes only

and does not constitute investment, legal, or tax advice.

Please see the full Legal Disclaimer at the end of this article.

TRUSTQ Newsfeed — January 5, 2026

U.S.–Venezuela: “Decapitation capture,” oil paralysis, and a trust earthquake in the hemisphere

What happened (ground truth from major reporting)

- U.S. forces captured Venezuelan President Nicolás Maduro and his wife during a major operation in Caracas; Maduro was transported to the U.S. to face charges. (Reuters)

- Oil exports halted amid turmoil and embargo pressure; tankers are stuck, storage is tightening, and production cuts become plausible if the logjam persists. (Reuters)

- The move triggered international blowback and regional split reactions (condemnation + applause). (Reuters)

- Analysts warn: no quick wins in “turning Venezuela back on” as an oil supplier; infrastructure, investment, legality, and governance make this slow. (Reuters)

This is not “just” a Venezuela story. It’s a rule-of-order story: how far the U.S. will go in the Western Hemisphere, what precedents it sets, and how quickly the energy and EM complex reprices political risk.

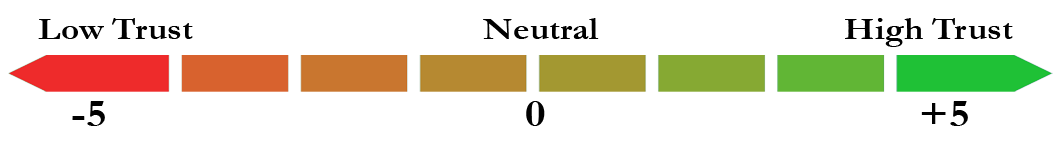

Optimal Trust Grid (36 cells, -5 to +5)

Scoring intent: these numbers represent trust conditions in the system right now, not moral judgment.

Rational = evidence-based predictability. Emotional = perceived safety/fairness/legitimacy.

Why these scores are where they are (the “OT diagnosis”)

- Integrity is the crater. A forced capture + talk of the U.S. “running” Venezuela creates maximum dispute over legitimacy and rules—especially internationally. (Reuters)

- Aligned Interests are negative at every level. The U.S. frames law-enforcement/national interest; Venezuelan regime loyalists frame sovereignty/occupation. Regional actors split hard. (Reuters)

- Competency is only mildly negative because the operation succeeded tactically—but governance competence and oil-restart competence are open questions and likely slow. (Reuters)

- Communications are degraded: competing narratives, fast-changing policy statements, and unclear “next governance” roadmap. (Reuters)

+ For a detailed breakdown of the scoring, see APPENDIX 1 at the end of this article.

+ For Trust Repair Levers that could actually change the Market Narrative, see Appendix 2.

Market meaning in two time horizons

1) Immediate reaction (days to weeks): “risk repricing + event volatility”

What matters most now: export disruption and policy uncertainty, not barrels-in-the-ground.

- Oil / refined products: exports are reportedly stopped, and storage constraints can force production cuts. That’s the near-term bullish pressure point—even if markets believe longer-term supply could return under a new regime. (Reuters)

- Energy equities: “bid on uncertainty” is plausible (risk premium), but don’t confuse that with a guaranteed sustained move—analysts emphasize slow rebuild. (Reuters)

- EM risk / LatAm spreads: expect knee-jerk widening in risk assets exposed to regime-change instability (especially where U.S. intervention precedent matters). (This is the Integrity/Meta-group score showing up in prices.) (Reuters)

2) Medium-term (months to years): “legal overhang + rebuilding reality”

- No fast oil renaissance. Venezuela’s operational capacity has decayed; restarting at scale is infrastructure + governance + capital + legal settlement. (AP News)

- Sanctions/licensing regime becomes the throttle. If the U.S. chooses selective licenses, blocked accounts, or transitional structures, it shapes who benefits and how fast barrels move. (Atlantic Council)

- Regional trust damage may outlast the event. Even allies who privately welcome Maduro’s removal may publicly resist the precedent—raising long-term diplomatic friction premium. (Reuters)

What advisors should say to clients (scripts that work)

The core framing (use this first)

“This is a policy-and-sovereignty shock, not a typical election headline. Markets will trade two things: (1) short-term oil disruption and (2) uncertainty about what replaces Maduro. We’re going to respond to facts and milestones, not emotion.”

Support: export paralysis + slow rebuild reality. (Reuters)

If clients ask “Is this bullish or bearish for oil?”

“Near-term, disruption risk can lift prices. Medium-term, even if Venezuela eventually produces more, that’s a slow, multi-year story. The market will bounce between those two narratives.”

Support: halted exports; no quick wins. (Reuters)

If clients ask “Is the U.S. at war with Venezuela?”

“It’s being framed by the administration as a targeted operation tied to indictments, but legal and international-law experts are openly disputing the justification. That legal ambiguity is why markets may keep a ‘risk premium’ in place.”

Support: Reuters legal analysis. (Reuters)

If clients are anxious: “Should we change my portfolio?”

“We don’t rebuild portfolios on one weekend. We check exposure: energy weighting, EM credit, defense, and transport. If you’re overconcentrated, we rebalance methodically—without chasing a spike.”

Support: investor reaction is event-driven; oil uncertainty. (Reuters)

Advisor playbook: what to do Monday morning

1) Map exposure (10 minutes, high ROI)

- % in Energy (integrated oil, refiners, services)

- % in EM debt / LatAm (sovereign + corporate)

- Airlines/Transport sensitivity (fuel)

- Any thematic positions tied to sanctions policy / political risk

2) Define three scenario branches (and pre-decide actions)

Scenario A — Stabilization + controlled licensing (less chaotic)

- Oil exports resume partially under transitional controls; risk premium fades.

- Action: fade “panic hedges,” keep disciplined energy exposure.

Scenario B — Prolonged paralysis / contested transition (messy center case)

- Exports remain stuck; sporadic violence; legality disputes intensify.

- Action: keep hedges; avoid concentrated EM risk; prefer quality energy over high-beta.

Scenario C — Regional escalation / broader sanctions spiral (tail risk)

- More strikes/sanctions; regional condemnation intensifies; shipping/insurance spikes.

- Action: tighten risk; raise quality; consider defensive tilts.

Support for uncertainty and export disruption: (Reuters)

The OT “most important lever” to watch

If you track only one thing, track Integrity + Communications at the Meta-group level:

- Are there credible international partners involved?

- Are there clear milestones for transition?

- Is there transparent treatment of oil revenues (blocked accounts vs. seizures vs. licensing clarity)?

That’s what determines whether this becomes a short volatility episode—or a multi-quarter risk premium embedded in energy and EM.

Support: uncertainty on governance, legal disputes, oil hurdles. (AP News)

Sector Impact Add-On — U.S.–Venezuela Shock (Jan 4, 2026)

Why sectors matter here

This event is a political action that instantly became an energy logistics problem: Reuters reports Venezuela’s oil exports have come to a complete halt, with loaded tankers stuck and storage nearing capacity—raising the risk of forced production cuts. (Reuters)

So the immediate “transmission mechanism” is: barrels don’t move → spreads/winners/losers reprice.

1) Energy & Refining (upstream, midstream, downstream)

Immediate (days–weeks)

Upstream oil & services:

- Net positive bias from risk premium and “headline scarcity” if Venezuela exports stay frozen. (Reuters)

- But avoid simplistic “oil up → energy up.” Market will constantly re-evaluate whether this freeze lasts.

Refiners (especially those configured for heavy crude):

- Risk: Venezuela is a heavy crude source; disruptions can tighten specific crude slates and shift crack spreads.

- Watch for volatility in heavy-sour differentials.

Chevron / Venezuela JVs:

- Reuters notes the paralysis also affects shipments involving PDVSA and Chevron (Venezuela’s key foreign partner). That’s a direct idiosyncratic risk point. (Reuters)

Medium-term (months–years)

- “Venezuela back online” is not quick: decaying infrastructure and operational constraints make sustained ramp a slow story. (Reuters)

- That means: short-term bullish disruption can coexist with long-term supply potential—and the market will whip between those narratives.

Advisor talking line:

“Near-term, this is a supply-and-logistics shock. Medium-term, it’s a rebuild-and-governance story. We don’t bet the portfolio on the weekend narrative.”

2) Shipping, Logistics, and Trade Finance

Immediate

- If loaded tankers are stuck and departures are not being authorized (per sources in the Reuters export-paralysis piece), maritime logistics sees operational friction and insurance uncertainty. (Reuters)

- Trade finance desks (letters of credit, cargo insurance, counterparties) tighten standards when title, sanctions exposure, and payment pathways are unclear.

Medium-term

- A persistent “U.S. will run Venezuela” posture (as reported by Reuters/CBS and Pentagon-linked coverage) raises the odds of legal contestation and retaliatory measures, keeping insurance/financing risk premia elevated. (Reuters)

Advisor talking line:

“Even if oil prices don’t spike, shipping and insurance risk can rise. That affects transports, some industrials, and trade-linked credit.”

3) Emerging Markets, LatAm Sovereign Risk, and Banking

Immediate

- This is an Integrity/Meta-group shock: Reuters reports legal experts are disputing the operation’s legality under international law, and that ambiguity tends to widen EM risk spreads because it signals a new intervention precedent. (Reuters)

- Expect clients to ask: “Does this change U.S. posture elsewhere?” That question alone can pressure LatAm risk assets.

Medium-term

- Regional reaction is split—Reuters describes both condemnation and applause across Latin America. That implies prolonged diplomatic friction risk and policy uncertainty. (Reuters)

- If the U.S. is perceived as setting a new playbook, investors may demand higher premia for jurisdictions with sovereignty and governance fragility.

Advisor talking line:

“This isn’t only Venezuela credit risk—it’s a hemisphere-wide ‘rules and precedent’ event. We’ll watch whether it becomes isolated or systemic.”

4) Defense, Aerospace, and Security

Immediate

- Reuters reports the operation involved extensive planning and significant military assets (special forces, aircraft, intelligence). That visibility tends to reinforce the “defense bid” in uncertain geopolitics. (Reuters)

Medium-term

- If this hardens into sustained U.S. presence or ongoing security operations, defense spending expectations can rise—BUT the market will want congressional/policy clarity.

Advisor talking line:

“Defense is often a volatility hedge in these regimes, but we treat it like any other allocation: sized, diversified, and not chased.”

5) Information Ecosystem: Media, Platforms, and “Narrative Risk”

This is new—and worth calling out because it affects client psychology.

- Wired reports social media flooded with disinformation and AI-generated imagery after the capture. That means client fear/conviction may be shaped by fake videos before facts settle. (WIRED)

Advisor talking line (super useful):

“Let’s anchor on confirmed reporting and ignore viral clips. In these moments, misinformation moves faster than markets.”

Quick “sector map” you can use in one sentence

“The first-order hit is energy logistics, second-order is shipping/insurance and EM spreads, third-order is defense and broader political-risk premia.”

- A) Impact on 3 Key Business Sectors

1) Energy Complex: upstream + refining + oil services

Why this is first-order: Reuters reports Venezuela’s oil exports have come to a complete halt, with loaded tankers stuck and storage nearing capacity—raising the risk of forced production cuts. (Reuters)

Immediate (days–weeks)

- Oil risk premium up: the market prices “barrels trapped” before it prices “barrels eventually restored.” (Reuters)

- Refining volatility (especially heavy crude balancing): disruptions can tighten specific grades and move spreads.

- Idiosyncratic headline risk around companies with Venezuela ties (licensing, sanctions exposure, JV uncertainty). (Reuters)

Medium-term (months–years)

- No quick supply rebound: Reuters describes decaying infrastructure and the need for billions to restore output. Translation: even a “transition” doesn’t mean fast barrels. (Reuters)

OT components driving this sector:

- Meta-group Integrity (rules/precedent) + Group Competency (ability to actually move barrels again). (Reuters)

2) Shipping, Ports, and Trade Finance

Why it matters: “Exports paralyzed” is literally a ports + permissions + insurance story. Port captains aren’t authorizing departures; vessels sit loaded or leave empty. (Reuters)

Immediate

- Marine insurance and war-risk clauses can jump.

- Trade finance tightens (letters of credit, cargo title, sanctions compliance uncertainty).

Medium-term

- If the situation becomes contested governance, you get persistent “friction costs”: delays, higher premiums, more compliance drag.

OT drivers:

- Communications (conflicting authority) + Integrity (is any deal enforceable?) (Reuters)

3) Emerging Markets and LatAm Financials

This is the second-order shock: markets reprice the precedent.

Immediate

- Reuters’ legal analysis highlights disputes over the operation’s legality under international law; that kind of ambiguity tends to widen EM risk premia. (Reuters)

- Clients will ask: “Does this change the U.S. playbook elsewhere?” That question alone can move spreads.

Medium-term

- Regional reactions split; even friendly governments may resist the precedent publicly, keeping political-risk premia elevated. (AP News)

OT drivers:

- Meta-group Integrity + Shared Values (sovereignty norms vs. enforcement claims). (Reuters)

- B) Impact on 3 Market Proxies (probability-weighted)

These are scenario ranges, not forecasts. The goal is to give you a clean client-conversation frame and a disciplined way to avoid headline-chasing.

Proxy 1 — WTI / Brent crude (front-month directionality)

Base case (55%) — “Paralysis persists for weeks”

- WTI/Brent: +3% to +8%

- Drivers: export halt + storage pinch + uncertainty premium. (Reuters)

- OT trigger: Group Competency (operational freeze) + Meta Integrity (uncertain end-state). (Reuters)

Bull case (25%) — “Production cuts + escalation rhetoric”

- +8% to +15%

- Catalysts: forced shut-ins, broader sanctions spiral, shipping/insurance stress. (Reuters)

Bear case (20%) — “Fast stabilization + licensed flows restart”

- -3% to -7%

- Catalysts: credible transition authority + ports reopen + clarity on exports.

Advisor line:

“Oil can pop on disruption, but the medium-term supply story is slow. We manage exposure—don’t chase a spike.”

Proxy 2 — Energy equities (XLE-style basket)

Base case (50%) — “Up on risk premium, then choppy”

- +2% to +6%

- OT driver: Meta Integrity shock lifts the “geopolitical premium,” but earnings reality caps euphoria.

Bull case (20%) — “Oil up + duration of disruption confirmed”

- +6% to +12%

Bear case (30%) — “Oil fades + policy uncertainty hits capex sentiment”

- -4% to -9%

- Why: markets start pricing “uncertain rules” as a drag on investment even if prices initially rose.

Support for “slow rebuild / billions / infrastructure decay”: (Reuters)

Advisor line:

“Energy stocks may benefit, but not all energy benefits equally. We prefer diversified quality over single-country optionality.”

Proxy 3 — EM risk proxy (EMB-style EM sovereign debt OR LatAm equity basket ILF)

Base case (55%) — “Risk premium widens, then stabilizes”

- EMB: -1% to -3% (price) / spreads widen modestly

- ILF: -2% to -5%

- Drivers: legality debate + precedent anxiety + regional political reaction split. (Reuters)

Stress case (25%) — “Broader LatAm political reaction / unrest / sanctions spiral”

- EMB: -3% to -6%

- ILF: -5% to -10%

Relief case (20%) — “Clear transition plan + containment signals from U.S.”

- EMB: 0% to +2%

- ILF: -1% to +3%

Advisor line:

“EM moves here aren’t about Venezuela GDP—they’re about ‘rules and precedent.’ We watch containment and clarity.”

- C) The advisor script pack (plug-and-play)

1) The opener (sets tone, prevents panic)

“This is a rare ‘sovereignty shock.’ Markets will trade two things: oil flow disruption now and governance clarity later. We’re going to act on milestones, not viral clips.”

Disinfo note (very real right now): Wired documents an explosion of misleading/AI-generated material after the capture. (WIRED)

2) The “should we do anything?” answer

“First we measure exposure: energy, EM, transports. If you’re overconcentrated, we rebalance methodically. We do not rebuild your portfolio on a weekend headline.”

3) The “what would change your view?” answer

“Three triggers: ports reopening + exports resuming, credible transition authority, and sanctions/licensing clarity.”

Export paralysis confirmation: (Reuters)

APPENDIX 1

Optimal Trust Grid

U.S.–Venezuela Crisis (January 2026)

Scale: –5 (severe trust breakdown) to +5 (strong trust)

Aligned Interests

Individual Level

Rational: –2

The Trump administration’s stated objectives (law enforcement, regime removal, strategic leverage) and Maduro’s objectives (regime survival, sovereignty, personal protection) are fundamentally opposed. Temporary overlap does not exist.

Emotional: –3

Personal animosity, humiliation, and perceived existential threat dominate. Any residual emotional alignment is extinguished by the nature of the capture.

Group / Institutional Level

Rational: –3

U.S. institutions are acting to dismantle the existing Venezuelan power structure, while Venezuelan state actors (military, PDVSA remnants, loyalists) are incentivized to resist, delay, or sabotage cooperation.

Emotional: –4

Within Venezuela, the event is widely framed as coercion or invasion; within parts of the U.S. system, Venezuela is framed as illegitimate or criminal. Emotional zero-sum thinking prevails.

Meta-Group / Global Level

Rational: –2

Some global actors share an abstract interest in stability and oil flow, but disagree sharply on methods and precedent. Alignment exists in theory, not execution.

Emotional: –3

The episode triggers long-standing fears about interventionism, colonial patterns, and sovereignty violations—especially in the Global South.

Communications

Individual Level

Rational: –2

Communication is indirect, mediated through press statements, indictments, and proxies. There is no functioning bilateral dialogue.

Emotional: –3

Messages are interpreted through fear, anger, and triumphalism, not mutual understanding.

Group / Institutional Level

Rational: –3

Multiple authorities speak at once (White House, DOJ, Pentagon, Treasury, regional governments), creating ambiguity about control, timelines, and next steps.

Emotional: –3

Conflicting narratives heighten anxiety and mistrust among institutions, investors, and populations.

Meta-Group / Global Level

Rational: –2

International messaging lacks a unified framework (law enforcement vs. military action vs. transitional governance), weakening clarity.

Emotional: –3

Global audiences split emotionally—some view the move as overdue justice, others as destabilizing force—polarization dominates.

Competency

Individual Level

Rational: –1

The operation itself demonstrates tactical capability, but provides no evidence yet of strategic competence in managing aftermath, governance, or economic normalization.

Emotional: –1

Confidence is cautious rather than panicked; observers acknowledge execution skill but question follow-through.

Group / Institutional Level

Rational: –2

Institutions appear unprepared for immediate consequences: halted oil exports, unclear port authority, and governance vacuum.

Emotional: –2

Markets and regional actors express unease about institutional readiness for second- and third-order effects.

Meta-Group / Global Level

Rational: –1

The international system has tools (sanctions relief, stabilization missions, financial oversight) but no agreed playbook for this scenario.

Emotional: –1

Skepticism outweighs confidence, but this is not yet seen as total incompetence.

Integrity

Individual Level

Rational: –3

The capture of a sitting head of state raises serious questions about legality, jurisdiction, and due process under international norms.

Emotional: –4

Perceived humiliation and betrayal dominate emotional responses, particularly in Venezuela and sympathetic states.

Group / Institutional Level

Rational: –4

Rules-based predictability is severely weakened: who has authority over assets, oil revenues, ports, and contracts is unclear.

Emotional: –4

Institutions assume bad faith from opposing sides; trust collapses rather than erodes.

Meta-Group / Global Level

Rational: –3

Precedent risk is high. Even allies worry about where the line is drawn and whether similar actions could be taken elsewhere.

Emotional: –4

Collective memory of intervention fuels resentment and fear, especially among non-aligned states.

Intentions

Individual Level

Rational: –2

The U.S. signals intent to “restore order” or “enable transition,” but offers no concrete, time-bound roadmap. Intentions are opaque.

Emotional: –3

Intent is emotionally read as punitive or dominating rather than stabilizing.

Group / Institutional Level

Rational: –3

Competing institutional goals (justice, deterrence, oil access, regional signaling) dilute perceived coherence of intent.

Emotional: –3

Fear of hidden agendas—resource capture, political messaging, or regime engineering—dominates perception.

Meta-Group / Global Level

Rational: –2

Some international actors see potential for stabilization; others see intent as unilateral power projection.

Emotional: –3

Global confidence in benign intent is low, even where outcomes might be welcomed.

Shared Values

Individual Level

Rational: –3

Leaders operate from incompatible value systems: rule-of-law enforcement vs. sovereignty and resistance.

Emotional: –4

There is virtually no emotional resonance or empathy across leadership narratives.

Group / Institutional Level

Rational: –3

Institutions disagree on core values: legality, democracy promotion, non-intervention, and economic control.

Emotional: –4

Cultural memory and ideological framing override any sense of shared norms.

Meta-Group / Global Level

Rational: –2

Minimal overlap exists around humanitarian relief and economic stabilization—but not on means.

Emotional: –3

Trust in a shared moral framework is weak and fractured.

Bottom-Line Trust Diagnosis (Advisor Summary)

- Primary rupture: Integrity + Communications

- Primary market transmission: Energy logistics → EM risk premium → political precedent

- Trust posture:

- Rational trust: Fragile but not collapsed

- Emotional trust: Severely impaired

This is why markets may remain volatile even if oil prices stabilize—the trust damage sits deeper than price alone.

APPENDIX 2

Trust Repair Levers: What Would Actually Change the Market Narrative

The trust breakdown now shaping the U.S.–Venezuela situation is not irreversible—but it is structural, not cosmetic. Markets are not waiting for peace, democracy, or moral consensus. They are waiting for signals that reduce uncertainty, restore predictability, and limit precedent risk. Within the Optimal Trust framework, those signals show up as concrete improvements in a small number of leverage points that cascade across multiple trust components. The three repair levers below represent the minimum conditions required to shift investor perception, narrow risk premia, and move this story from open-ended shock toward managed transition.

Here are three concrete Trust Repair Levers, written in the TrustQ / OT idiom, each explicitly tied to which trust cells move, what markets would notice, and what advisors should watch for. These are not aspirational—each is operationally testable.

Trust Repair Lever #1

Restore Integrity Through Verifiable Legal Process

What must change

Move the Maduro case from power event to rules-based process:

-

Transparent jurisdictional basis

-

Clear charges, timelines, and rights

-

International legal observers or parallel multilateral review

OT cells this repairs

-

Integrity (Individual, Group, Meta-group) ↑

-

Intentions (Meta-group / Rational) ↑

-

Secondary lift to Communications (credibility)

Why this matters

Right now, markets are pricing precedent risk—not just oil risk.

A visible, procedural legal pathway reduces fear that this was arbitrary or improvisational.

Market signal to watch

-

Shift in global media language from “capture” / “seizure” → “trial” / “proceedings”

-

Narrowing of EM sovereign spreads unrelated to oil price moves

Advisor translation

“If this moves decisively into a transparent legal process, it lowers the risk that this becomes a template elsewhere. That’s when risk premia start to ease.”

Trust Repair Lever #2

Clarify Governance & Oil Revenue Custody

What must change

Resolve the single biggest operational ambiguity:

-

Who controls PDVSA assets and export authority

-

Where oil revenues are held

-

What conditions govern licenses and flows

This must be stated in writing, with enforcement clarity.

OT cells this repairs

-

Competency (Group / Rational) ↑

-

Integrity (Group / Rational) ↑

-

Aligned Interests (Meta-group / Rational) ↑

Why this matters

Markets don’t need democracy tomorrow.

They need clarity on who can sign, ship, insure, and get paid.

Right now, trust is blocked at the transaction layer.

Market signal to watch

-

Ports reopening with insured cargoes

-

Named escrow structures or custodial arrangements

-

Reduction in shipping and war-risk insurance premia

Advisor translation

“This is the difference between theoretical oil supply and real barrels. When custody is clear, volatility drops—even if production stays low.”

Trust Repair Lever #3

Multilateralize the Transition Narrative

What must change

Shift the story from unilateral U.S. action to shared stewardship:

-

Visible roles for regional bodies, allies, or neutral institutions

-

Defined limits on U.S. authority and duration

-

Explicit acknowledgment of sovereignty sensitivities

OT cells this repairs

-

Shared Values (Meta-group / Emotional & Rational) ↑

-

Communications (Meta-group / Emotional) ↑

-

Aligned Interests (Meta-group) ↑

Why this matters

This is the emotional trust lever.

Without it, even good outcomes will be mistrusted—and mistrust keeps risk premia high.

Markets care because emotional trust shapes capital flight, sanctions durability, and alliance cohesion.

Market signal to watch

-

Joint statements (not endorsements) from non-U.S. actors

-

Reduced rhetorical escalation from LatAm governments

-

Stabilization in LatAm equity and FX independent of oil

Advisor translation

“When more than one adult is visibly in the room, markets relax. This is about legitimacy, not speed.”

Bottom-Line Synthesis (for you, not clients)

-

Lever 1 (Legal Integrity) repairs precedent risk

-

Lever 2 (Operational Clarity) repairs market plumbing

-

Lever 3 (Multilateral Legitimacy) repairs emotional trust

You do not need all three at once to see market relief.

But without at least two, volatility remains structurally justified.

Legal Disclaimer

This TrustQ Newsfeed content is provided for informational and educational purposes only and does not constitute investment advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security, commodity, or financial instrument.

The analysis presented herein reflects an Optimal Trust (OT) framework–based interpretation of publicly available information as of the date of publication. It is intended to help financial advisors contextualize geopolitical and market developments and support informed client conversations. It does not represent a prediction, guarantee, or definitive assessment of future events or market performance.

All market scenarios, probability-weighted outcomes, sector impacts, and trust scores are illustrative, not forecasts. Actual outcomes may differ materially due to changes in political decisions, legal rulings, regulatory actions, military developments, market conditions, or other unforeseen factors.

This content should not be relied upon as a primary basis for investment decisions. Financial advisors should conduct their own independent analysis, consider client-specific objectives, risk tolerance, and circumstances, and consult appropriate compliance, legal, or investment professionals before making any recommendations or portfolio adjustments.

References to specific countries, leaders, companies, sectors, or markets are made solely for analytical purposes and do not imply endorsement, condemnation, or factual certainty beyond what is reported by cited public sources. Information derived from news reporting is subject to revision as events evolve.

Neither Optimal Trust, TrustQ, nor the authors or contributors assume any responsibility for errors, omissions, or subsequent developments, nor for any losses or damages arising from the use of this material.

Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

T Terms of Use Disclaimer Privacy Policy Contact Us

For more info call: (347)-474-8090

Copyright 2025, All Rights Reserved

© Copyright OPTIMAL TRUST