OPTIMAL TRUST RESPONSE to RFI from the Office of the Comptroller of the United States Treasury

This document presents our recommendations to the Office of the Comptroller of the Currency of the United States Treasury. We have prepared it in response to an RFI concerning the Annual Consumer Trust in Banking Survey.

OPTIMAL TRUST SUMMARY

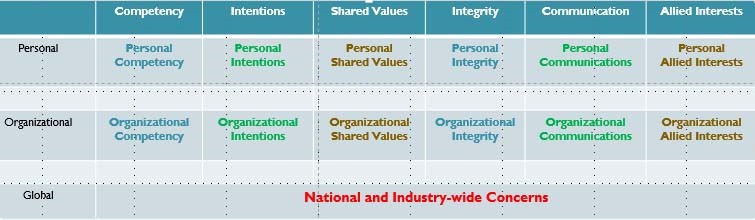

The Optimal Trust framework is based on the premise that Trust operates on multiple levels: the individual (people), groups (communities, families, organizations, businesses, etc.), and meta-groups (industries, systemic, global, etc.). Using a unique grid, Optimal Trust identifies up to 36 distinct aspects of Trust. This in-depth approach turns the vague concept of Trust into measurable data, providing accurate results with minimal bias.

Furthermore, by using machine learning, the Optimal Trust model assigns aspects of Trust to unstructured text, transforming qualitative information into quantified data. When integrated with other pertinent metrics within the banking system, the Optimal Trust framework serves as a basis for developing actionable, targeted strategies to improve the quality of Trust between parties.

INTRODUCTION to OPTIMAL TRUST

The Office of the Comptroller of the Currency (OCC)'s Request for Information (RFI) emphasizes the critical importance of understanding and enhancing trust within the banking sector. Our Optimal Trust (OT) framework is directly aligned with this objective, offering a comprehensive model that breaks down trust into distinct, measurable characteristics. By translating Trust from an abstract concept into tangible elements, the OT framework provides a structured means to assess, analyze, and bolster Trust at various levels, be it individual, organizational, or systemic.

Furthermore, our software isn't just about numbers; it can also make sense of written feedback. With the help of modern AI, it reads and understands text-based information, turning those insights into measurable data. This gives a fuller picture of Trust, helping institutions to truly grasp and address concerns. The ability to transform qualitative insights into quantifiable metrics presents a transformative opportunity for understanding and enhancing Trust.

The Optimal Trust (OT) model employs a unique grid system that meticulously dissects Trust into its elemental characteristics:

- OT quantifies and measures up to six discrete Components of Trust:

- Competency, Intentions, Shared Values, Integrity, Communications, and Allied Interests

- OT recognizes that Trust operates on three Levels:

- Individual (Personal), Organizational (Institutional), and Global (Systemic).

- OT explores two Dimensions of Trust:

- Rational (Cognitive) and Emotional (Affect)

Grids can also be simple, using as few as 3 Components.

When Trust is delineated into distinct and specific characteristics, it can be more effectively quantified, yielding precise data that is both accurate and less subject to bias. When integrated with other relevant metrics within the banking system, the Optimal Trust framework serves as a basis for formulating strategic pathways to enhance the quality of Trust between parties.

The Optimal Trust framework and its software are inherently flexible. The program can be adapted to fit an organization's unique needs and structures. In addition, we are open to developing pilot projects to validate, refine, and maximize the model's potential.

The framework originated from our work with one of Wall Street's prominent financial institutions – Merrill Lynch / Bank of America. It emerged as a strategic response from the management to counteract what they identified as a severe erosion of Trust within their client and customer base following the financial turmoil of 2008.

Given the OCC's pivotal role in safeguarding and promoting trustworthiness within the banking system, we see a natural synergy between your objectives and the capabilities of the Optimal Trust framework. We invite you to review the attached RFI for a comprehensive understanding of the depth and potential of the Optimal Trust framework.

DEPARTMENT OF THE TREASURY:

Office of the Comptroller of the Currency

Request for Information on Annual Consumer Trust in Banking Survey

AGENCY: Office of the Comptroller of the Currency (OCC), Treasury.

ACTION: Request for information and comment.

As a preliminary step, we furnish an introduction to the Optimal Trust framework. This information provides the contextual background for our responses to the questions in the Request for Information (RFI).

For each subsequent section, we will first summarize the questions and explore possible underlying implications. Next, we will address the entire section as a cohesive unit rather than respond to individual questions.

INTRODUCTION

The Optimal Trust® (O.T.) framework is based on the premise that Trust operates on multiple levels: the individual (people), groups (communities, families, organizations, businesses, etc.), and meta-groups (or groups of groups, industries, systemic, global, etc.). Optimal Trust measures - and quantifies - how all of these aspects of our world come together to form constantly evolving, complex systems of interconnectedness.

The framework is a simple, straightforward model that is easy to understand and quick to implement. Yet, it can expand and analyze even the most sophisticated and complex scenarios.

The framework originated from our work with one of Wall Street's prominent financial institutions – Merrill Lynch / Bank of America. It emerged as a strategic response from the management to counteract what they identified as a severe erosion of Trust within their client and customer base following the financial turmoil of 2008. This initiative also sought to tackle the erosion of Trust that had permeated the organization. Their internal surveys underscored a pervasive breakdown of Trust across various stakeholders, spanning teams, and between upper management and the broader company.

In 2018, a collaborative effort ensued between the authors and The Center of Ethics at St. Thomas University (Miami Gardens, Florida). The collaboration resulted in educational programming centered on ethical principles – Ethical Trust®. The program and framework underwent further independent development, creating a new iteration, ultimately called Optimal Trust®.

THE OPTIMAL TRUST GRID

Optimal Trust (OT) employs a visual grid that is easy to conceptualize:

- OT quantifies and measures up to 6 discrete Components of Trust:

- Shared Values, Competency, Intentions, Allied Interests, Integrity, and Communications.

- OT recognizes that Trust operates on three levels:

- Individual (Personal), Organizational (Institutional), and Global (Systemic).

- OT explores two dimensions of Trust:

- Rational (Cognitive) and Emotional (Affect)

When Trust is delineated into distinct and specific characteristics, it can be more effectively quantified, yielding precise data that is both accurate and less subject to bias. When integrated with other pertinent metrics within the banking system, the Optimal Trust framework serves as a catalyst for formulating strategic pathways aimed at enhancing the quality of Trust between parties.

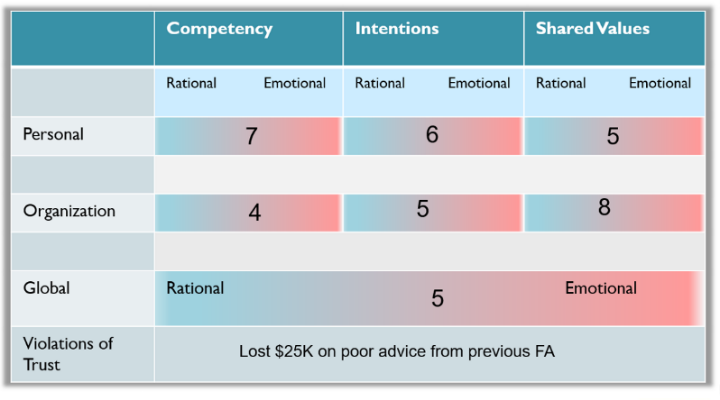

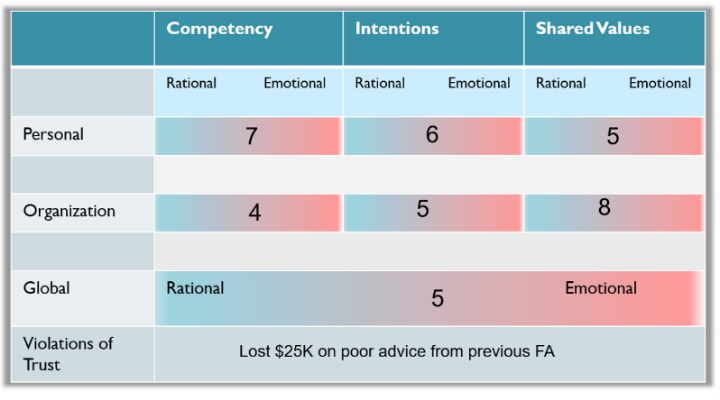

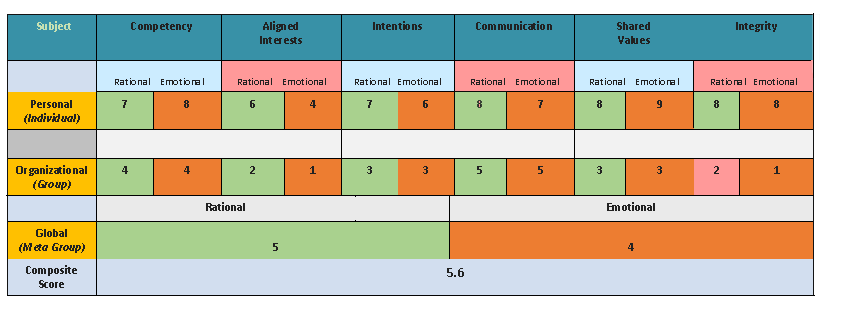

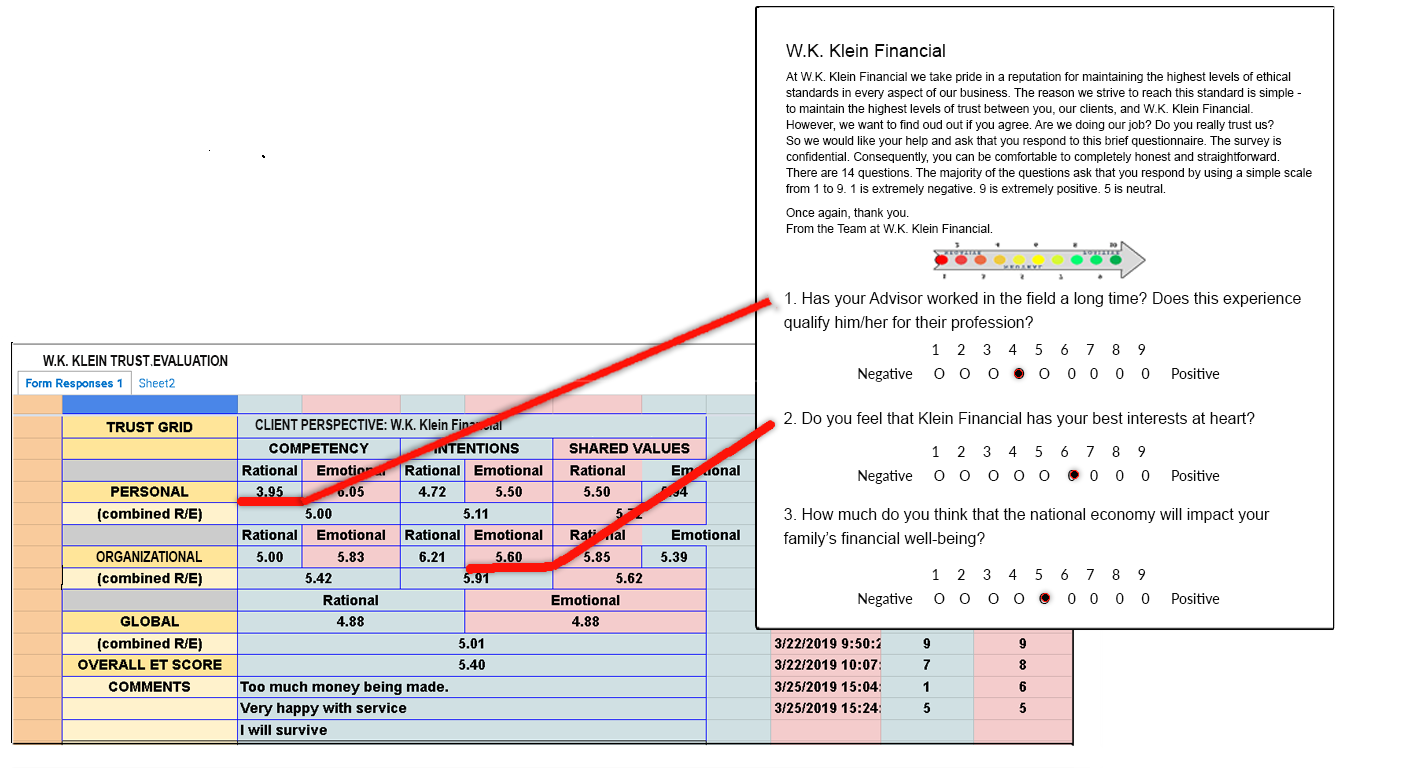

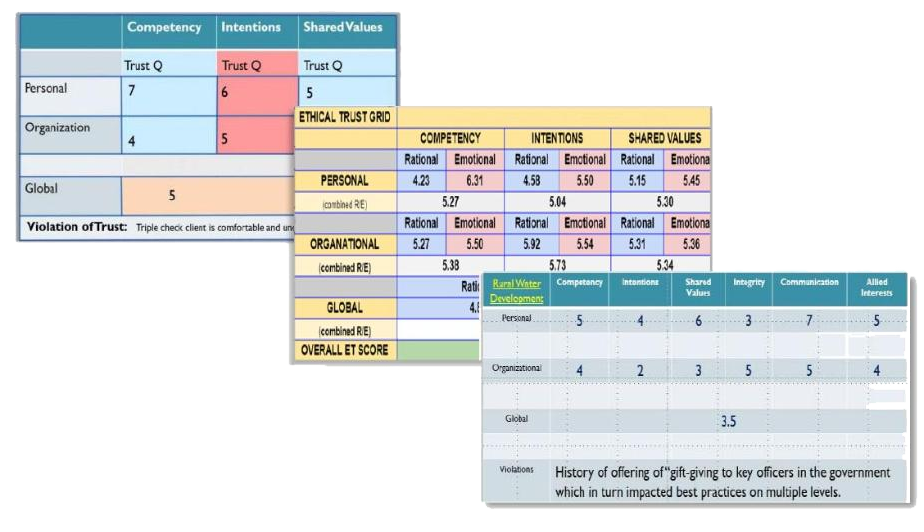

Samples of the Optimal Trust Grid:

Grids can be simple, using as few as 3 Components.

Grids can become increasingly sophisticated depending on the context.

Above is a sample of a mock online survey conducted in real-time.

Each question/answer in the survey is tied to its appropriate cell in the Trust Grid.

The resulting numbers are the average of the total respondents' choices.

Optimal Trust Technologies

(All the software technologies listed in this document are under development, with the first versions scheduled for release in the 4th Qtr of 2023.)

Automated Question Generation Wizards

Creating questions can be automated to gather specific data that uncovers the subtle aspects of Trust. The framework calls upon a broad vocabulary library of words associated with Trust and its Components, Levels, and Dimensions.

Questions are crafted to uncover specific and nuanced concerns that might be missed in other surveys. Correctly phrased survey questions can shed light on vital issues. For instance, questions regarding intentions (goodwill) can help determine if respondents mistrust a bank due to personal experience or broader doubts about the banking system. Is their skepticism based on logical reasons, or do emotions like frustration and anger influence it?

With this detailed information, institutional regulators and banks can pinpoint and address the exact challenges. Entities like the OCC, or even local banks, can then take informed action.

![]()

Sample of a portion of Optimal Trust Lexicon

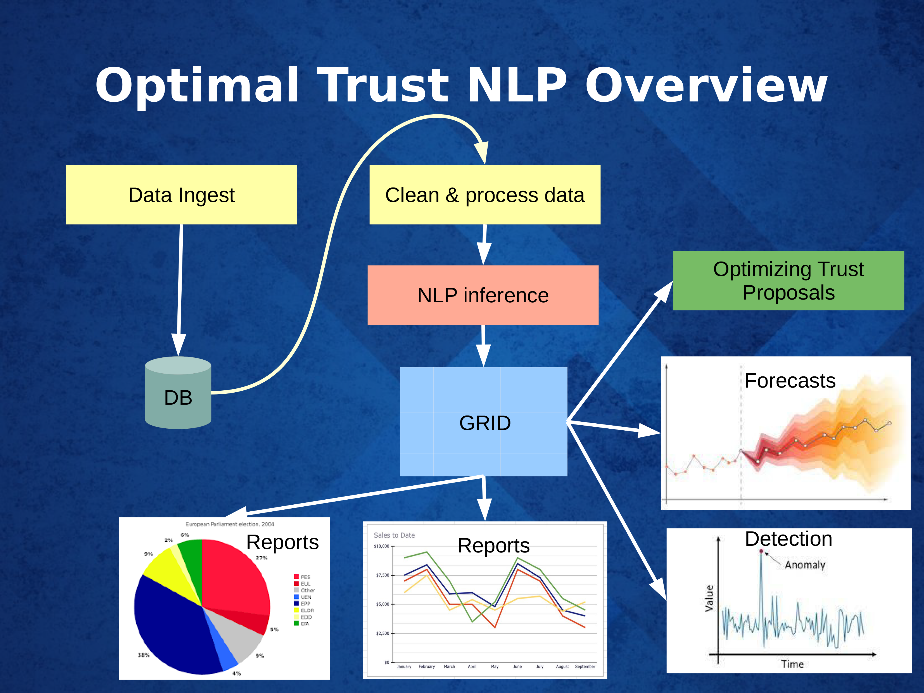

Machine Learning (A.I.) Data Analysis:

The Optimal Trust technology scans and assigns meaning to text-based (natural language) inputs, transforming and quantifying them in alignment with the Optimal Trust framework.

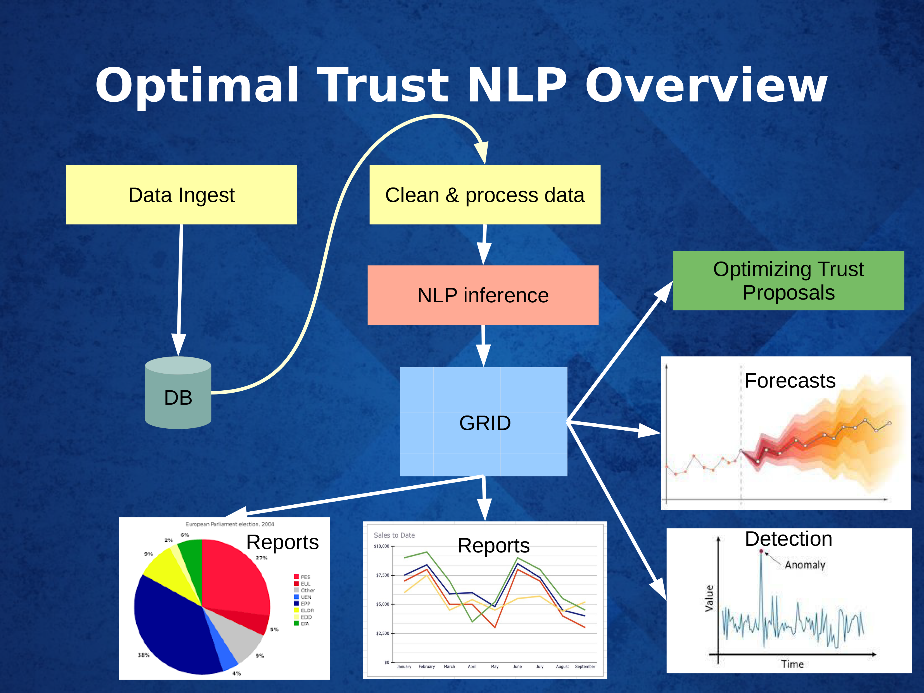

The flow and processing of data to extract meaningful information

The system continually leverages state-of-the-art Machine Learning (AI) models to refine its analytical capabilities. These refinements will be able to scan historical data, assess real-time online feedback, integrate findings from current and prospective surveys, and formulate predictive insights.

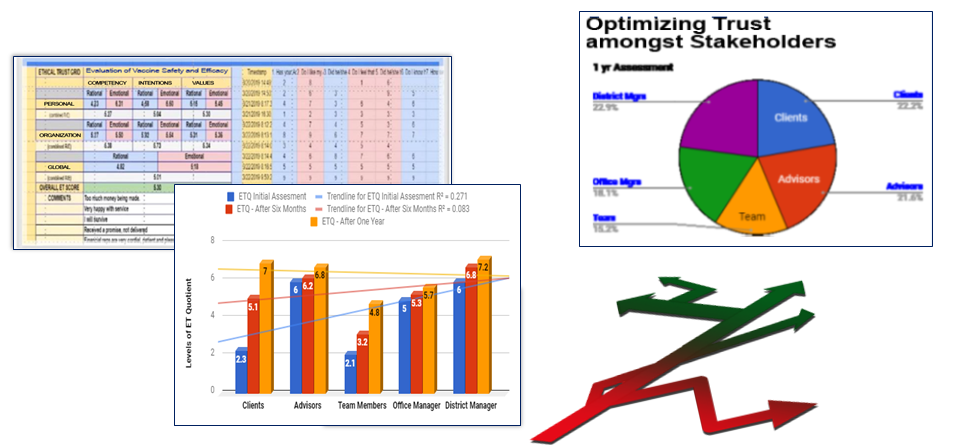

Optimizing Trust

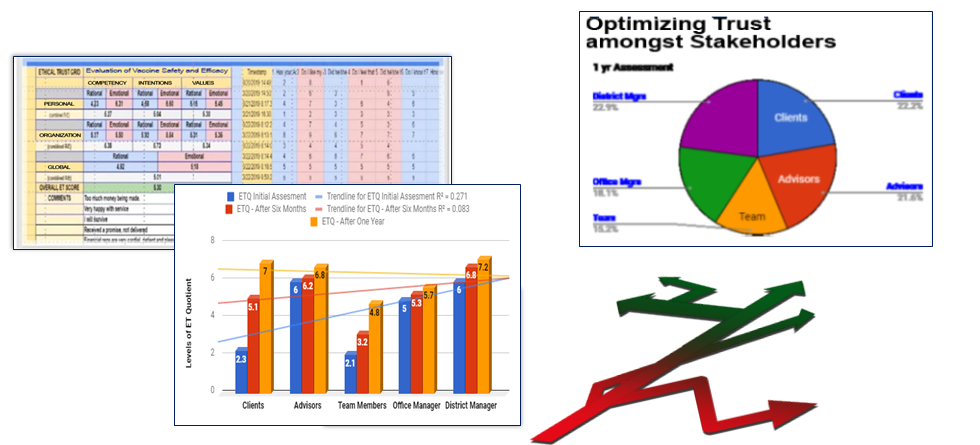

Optimizing Trust amongst Stakeholders

In a landscape where each stakeholder - be it individuals, banks, financial institutions, or regulatory bodies - has its own set of interests and expectations, achieving a common understanding of Trust can be challenging. By offering tools and methodologies that gauge Trust levels, it sheds light on areas of convergence and divergence among stakeholders.

Furthermore, the framework's data-driven insights allow for proactive interventions, enabling entities to address trust deficits before they escalate into larger issues. The continuous feedback loop within the O.T. system ensures that trust-building measures are not just reactive but also anticipatory. By highlighting emerging trends and shifts in stakeholder sentiments, Optimal Trust allows financial entities to stay ahead of the curve, cultivating a culture of Trust that's resilient to external shocks.

At its core, the Optimal Trust framework doesn't just measure Trust; it cultivates and nurtures it, ensuring that every stakeholder's interests are acknowledged, respected, and harmonized for the collective good.

PART ONE: SCOPE OF SURVEY

Questions 1 to 8, when taken together, represent OCC's aim to assess the scope of the survey. By considering various population segments, focusing on distinct financial products, and differentiating between types of financial institutions, including emerging fintech platforms, the OCC intends to capture a comprehensive yet nuanced snapshot of trust levels and determinants within the financial sector.

In these questions are several underlying implications:

- Diverse Population Needs: Targeting specific segments, including the unbanked and underbanked, implies understanding and addressing inequalities or gaps in financial services and trust levels across varying demographics.

- Historical Trust Issues: The emphasis on annual trust surveys points towards concerns arising from past events where Trust in the financial system was severely eroded.

- Product & Service Differentiation: Asking about specific financial products/services suggests that the OCC realizes Trust might not be uniform across all banking services.

- Regulatory Scope and Role Clarification: Differentiating between federally chartered depository institutions and state-chartered ones indicates the OCC is assessing its own regulatory reach and potentially seeking to clarify or redefine its role.

- Anticipation of Future Trends and Evolving Financial Landscapes: Including non-traditional banking entities like fintech firms implies recognizing the changing nature of financial services and the need to measure Trust across newer platforms.

- Strategic Decision Making: Surveys serve a dual purpose. While they aim to measure Trust, they also offer insights that could inform strategic decisions related to regulatory policies, oversight mechanisms, and consumer protection.

- Broad Data Collection Strategy: The diverse questions imply an ambition to gather extensive data to gain comprehensive insights to make informed decisions in a complex financial ecosystem.

The implied scope of the OCC survey is extensive, suggesting more of an aspirational blueprint than an immediately actionable plan, especially when considering logistical and budgetary constraints. This ambitious objective might take several years to realize fully. However, there is significant merit in establishing a flexible blueprint and framework. As technology advances and the data landscape shifts, a robust and adaptive framework ensures that the surveys remain relevant and comprehensive – and can seamlessly integrate newer data sets and insights.

The Optimal Trust Framework and the Long View

We propose that the Optimal Trust (O.T.) framework could be an effective model for realizing the OCC's vision for a thorough Assessment of Trust. The O.T. framework is not just valid in the current landscape but is designed to expand in detail, effectiveness, and accuracy, capturing the nuances of the entire population. This depth and flexibility ensure its relevance and significance both in the present and as we move into the future.

The Optimal Trust Framework:

Exploring Trust's Many Sides: The O.T. framework highlights Trust's multifaceted nature and tailors its methodology to resonate with varied U.S. population segments. From the unbanked and underbanked to specific demographic clusters, the O.T. strategy pinpoints Trust elements specific to each segment:

- Components: Competency, Shared Values, Integrity, Intentions, Allied Interests, Communications

- Levels: Individuals (personal), Organizations (institutions), Systemic (global)

- Dimensions: Rational, Emotional

- Setting a Uniform Data Benchmark: The O.T. system provides a consistent strategy for measuring Trust. This approach allows us to compare trust values across different banking services and financial institutions. Its structured tactic ensures uniform data interpretation across individual clients, banking entities, and policy-making bodies.

- Quantifying Trust Across Financial Products/Services: The O.T. framework quantifies Trust precisely, allowing for an evaluation of Trust dynamics across different financial products and services using a consistent methodology.

- Flexibility and Scalability: The O.T. framework can adapt its approach, whether the survey focuses on a niche (like only federally chartered institutions) or broadens its scope (including fintechs). This flexibility ensures the framework remains relevant and provides actionable insights, regardless of the survey's scope.

- Integrative Technologies: Automated question-generation tools and advanced machine learning features enhance the Optimal Trust (O.T.) framework. Notably, it has the growing capacity to analyze and quantify text-based information.

- Real-Time and Predictive Capabilities: As the Optimal Trust software technology matures and becomes operational, it will update data in real time. The software will be able to generate predictive trust models by analyzing news and information sources from other databases, including banking and economic indicators.

- Long-term Validity: The O.T. framework aligns with shifting financial landscapes, consistently delivering insights that align with evolving financial trends. It addresses today's challenges and establishes a strong foundation for the future.

- As the financial landscape evolves, O.T. will stay in step, offering ongoing insights that will be relevant and consistent with future developments in the financial sector. Optimal Trust's forward-looking approach addresses today's logistical and budgetary constraints by offering a foundation built to last, providing insights deep into the future.

In summary, the Optimal Trust framework offers a comprehensive, flexible, and extensive approach to understanding Trust in the financial sector.

PART TWO: COMPONENTS OF TRUST(3)

Questions 9 through 13 explore the multifaceted nature of consumer trust in financial institutions. It acknowledges that Trust is an elusive concept, lacking a clear consensus on its precise definition. It suggests that competence, goodwill, integrity, and transparency are key components that influence Trust. The subsequent questions seek to determine the suitability and utility of these component definitions, assess their comprehensiveness, identify potential redundancies, gauge the importance of differentiation, and understand how contextual factors such as institution type, financial services, and customer segments affect their relative significance.

The questions centered on the "Components of Trust" aim to clarify and validate the characteristics of Trust. However, the questions hint at several unstated implications:

- Potential Gaps in Definitions: The OCC asks if their definitions of the Components of Trust are too broad, too narrow, or misaligned with the concept of Trust in the context of financial institutions.

- Inclusiveness and Exclusiveness: By inquiring about the comprehensiveness of Trust components and then asking if some are superfluous, there's an indication that there's a delicate balance to strike. Overly simplistic models might miss nuances, while overly complex models might dilute focus.

- The Multifaceted Nature of Trust: If Trust is not a monolithic concept, it might need tailored approaches to fully understand it – depending on the context, the size or type of a financial institution, the services/products they offer, or the demographic they serve.

- Strategic Decision-Making: Given the potential variability in the importance of trust components across different scenarios, there's an implicit understanding that financial institutions might need to develop customized trust-building strategies for different segments of their customer base.

While overtly focused on defining and understanding the components of Trust, these questions underscore the complex, multifaceted, and context-dependent nature of Trust within the financial sector. They also hint at the need for precision in understanding Trust to manage and enhance it effectively.

The Optimal Trust framework multidimensional platform processes collected data to provide clear and actionable insights. The O.T. framework offers a detailed, transparent, yet unifying view, enabling a deeper understanding of how Trust functions in different scenarios.

The Components of Trust

The Optimal Trust Grid is flexible. It adapts to the unique context of each survey. Consequently, the X-axis on the O.T. Grid uses any number of Trust Components. In the example below, the O.T. Grid consists of six Components. (Competency, Aligned Interests, intentions, Communications, Shared Values, and Integrity.)

But this number can be adjusted to three, four, six, or more, depending on the specific context. This adaptability is crucial, ensuring that the choice of Components remains flexible, aligning with the ever-shifting nature of Trust itself.

(One of the challenges faced is selecting the exact terminology for each component category. For instance, while the RFI employs the term "Goodwill," the O.T. framework uses "Intentions." Similarly, "Transparency" in the RFI corresponds to "Communications" in the O.T. framework. We will delve deeper into the complexity of word choice in the subsequent section titled "The Language of Trust.)

The X-Axis represents The Components of Trust

The Levels of Trust

The O.T. framework integrates a Y-Axis, reflecting that Trust operates on multiple levels:

- Individual / Personal: This level pertains to individual relationships, focusing on person-to-person interactions. (Individual)

- Organizational / Institutional: This level encompasses relationships between an individual and an organization or community.

- Group)Systemic / Global: At this level, the framework considers relationships between individuals and organizations with larger systems or cultures, such as the financial system. (Meta-Groups)

The Y-Axis represents The Levels of Trust

Dimensions of Trust(5)

Research confirms that Trust encompasses both rational (cognitive) and emotional (affective) dimensions. Grasping the distinctions and exploring their interplay holds substantial importance when analyzing data. The Dimensions of Trust are as follows:

- Rational - Trust is based on intellectual, word-based, rationalizations, cost-benefit analyses, etc.

- Emotional - Trust is also a strong feeling – positive or negative - based on experiences, relationships, shared values, perceived violations, etc.

Incorporating these aspects contributes to enhancing the precision of the O.T. framework.

The Rational/Emotional represent further Dimensions of Trust

Depending on the context, surveys can use a simplified three-component or more intricate models, providing versatility in research.

PART THREE: MEASURING AND TRACKING TRUST

Questions 14 through 21 consider survey focus – whether on individual, institutional, or system-level Trust – and the use of direct and indirect measurement methods. The questions explore the adequacy of identified trust drivers, the role of personal characteristics, and the significance of understanding them for measurement in influencing Trust. Consumer trust in bank regulators and government is also considered. In addition, the advantages and drawbacks of a sole banking regulator conducting the survey are touched upon, along with the potential for alternative approaches, such as joint surveys with other federal bank regulators.

However, these questions also hint at deeper, unsaid implications:

- Nuanced Understanding of Trust: The distinction between system-level Trust and Trust in one's own bank suggests that people might trust their bank but be wary of the broader financial system or vice versa. This nuanced understanding of Trust is crucial because broad mistrust could trigger systemic issues even if individual banks are trusted.

- Complexity of Trust Measurement: The query about direct vs. indirect measures indicates that Trust is multifaceted and may not be straightforward to measure. One result: Proclamations of expressions of Trust may not align with real-world actions.

- Potential Gaps in Understanding the Drivers of Trust: The question asking about the comprehensiveness of trust drivers implies that there might be unidentified or overlooked factors that play a crucial role in shaping Trust.

- Demographic Variability: By bringing up personal characteristics as influencing Trust, there's an implication that trust levels might significantly vary among different demographic groups. Therefore, a "one-size-fits-all" approach might not be effective.

- External Influences: The mention of government and bank regulators recognizes that Trust in financial institutions doesn't operate in a vacuum. External entities' actions, credibility, and policies can have ripple effects on consumers' Trust. The question raises the concern of how these external entities manage their image and actions.

- Potential for Bias: The question about a single banking regulator conducting the survey versus multiple regulators implies concerns about potential biases or blind spots in the findings. Will the survey's reach be comprehensive? Will it reflect the full spectrum and demographics of the public?

- Evolving Financial Landscape: Trust in financial institutions is not static. As economic conditions, personal experiences, regulations, and government oversight change, so might the levels and drivers of Trust.

In summary, while the questions aim to grasp how to measure and understand Trust in financial institutions, they also hint at deeper challenges and nuances in managing, maintaining, and enhancing Trust in a complex, interconnected financial ecosystem.

Optimal Trust

An effective survey aims to generate accurate, comprehensive, and unbiased data that can be deemed "trustworthy." Moreover, the generated data should ideally offer actionable insights, furnishing roadmaps for potential targeted courses of action, which might encompass regulatory adjustments or other strategies. The proposed survey aims to capture the complex interactions of factors influencing Trust at various levels and contexts, from an individual's Trust in their local branch staff to their confidence in the bank and the broader banking system.

The Optimal Trust framework can be adapted to support these goals, The result would be integrating the OCC survey data into a coherent grid. This grid effectively represents three distinct layers of the financial landscape – from individuals and their local banks to larger institutions and the overarching systemic structure. One of the framework's strengths lies in its ability to facilitate the seamless data flow across these levels.

The Optimal Trust framework is flexible and can be modified to work with the OCC survey models, tailoring questions to specific Components of Trust at different Levels.

Using this approach in the survey design allows for a thorough examination of Trust across three levels: Individual, Organizational, and Global. This design aids in pinpointing concrete measures to tackle trust-specific issues, fostering a more robust and dependable financial system. The Optimal Trust framework helps connect the dots between gathering data and taking impactful actions.

Qualitative versus Quantitative Data

Distinguishing between qualitative and quantitative data presents a critical challenge for any large-scale survey aiming to query consumers' perceptions of the banking system. While scaled questions with precise numerical responses have merits, qualitative research offers further insights. However, it's through qualitative methods that respondents reveal their thoughts and emotions – in their own words.

For instance, consider questions examining customers' reactions to a bank creating fictitious accounts:

- Are their concerns rooted in a perceived lack of integrity, incompetence, or malicious intent?

- Who do respondents hold responsible: the employees, the organization, or the underlying system?

- Are the reactions primarily rational or emotional?

We could, of course, query respondents quantitatively and elicit valid and valuable information. But what if we let respondents write or speak about such scenarios in their own words?

The O.T. technology will allow respondents to comment on each question, if relevant, and then interpret, assign value to, and transform these comments into quantitative data.

The Optimal Trust (O.T.) technology draws upon a large lexicon of trust-related words to generate questions that pertain to specific trust components across all levels. This embedded lexicon also empowers the evolving Machine-Learning-based technology to analyze text-based language in detail. Through its linguistic and analytical capability, the O.T. technology enables precise quantitative - and qualitative - data measurement.

The Language of Trust

A challenge arises from the extensive vocabulary related to Trust's characteristics. The O.T. framework continuously expands its vocabulary to encompass words linked to Trust and its Components. The lexicon includes positive and negative synonyms, antonyms, and words that reflect rational and emotional nuances. With an understanding of language subtleties, the O.T. framework and technology will become adept at addressing various demographics, cultural settings, and professional situations.![]() Sample of a portion of Optimal Trust Lexicon

Sample of a portion of Optimal Trust Lexicon

In addition to scaled survey responses, Optimal Trust (O.T.) technologies will scan and interpret written and spoken text. This technology automates "comprehension" of the data. It assigns context-based meaning, draws conclusions, and quantifies data into the O.T. grid – to reflect how individuals think and speak. This technology leverages Machine Learning capabilities and its ability to analyze and provide credible evaluations.

And it will continually improve over future iterations, expediting the acquisition of informed, practical data across a broad range of respondents. Finally, the extracted information will equip the OCC with a significantly more comprehensive and reliable dataset for its work.

While logistical and budgetary constraints may have previously limited the collection and analysis of oral and written responses, O.T.'s technology now facilitates gathering and analyzing these responses.

Understanding Violations of Trust

A critical objective of surveys about the banking sector should include the specifics of "trust violations," not just in abstract terms but in granular detail, including the narratives of what transpired. Understanding these intricacies is essential, as trust violations are often complex and involve an emotional-rational cycle – particularly when the violations concern money and finance. Incorporating data linked to real-life scenarios equips the OCC with the insights needed to formulate actionable strategies spanning all tiers of the banking system.

Many individuals may find scale-based surveys frustrating, especially when discussing complex or emotionally charged topics like Trust – and the safety of their money – in the financial system. The Optimal Trust framework allows survey respondents to convey their opinions and experiences more authentically – by enabling them to express their views through scaled questions and personal comments. Surveys that capture a broader range of insights by providing various avenues for feedback promote a more robust and insightful analysis of trust-related issues.

Trust, Money, and the Financial System

Interestingly, the OCC's RFI never mentions the term "Money". However, it's crucial to recognize that, for the average consumer, banking is inherently linked with "Money"- a word loaded with emotional and psychological associations. Few words in any language elicit such potent emotions, spanning the spectrum from profound positivity to deep negativity.

Emotionally, our relationship with money is deeply personal. Thus, Trust in banks is essential. After all, we entrust them with our hard-earned savings, dreams of homeownership, or the capital to start a new business. Conversely, a breach of this Trust, such as a banking crisis, can elicit powerful emotions of fear or betrayal. Money and banking are inextricably intertwined, both intellectually and emotionally.(4)

Different groups perceive "money" uniquely, both intellectually and emotionally. Recent immigrants may see it as a path to stability and opportunity, yet their past experiences with unstable banking systems may initially foster mistrust. Blue-collar workers may view money as a reflection of their labor, linking it to family security, but often undercut by societal and economic frustrations. Middle-class families may associate money with saving for their children's education, balancing aspirations against everyday financial challenges. Entrepreneurs may see money as vital capital, accompanied by the personal exhilaration and stress of business risks. Sophisticated investors may treat it as a tool for wealth generation, balancing confidence with market uncertainties.

To encapsulate some of the underlying issues:

- Emotions Matter: Trust is not just about thinking but about feeling safe and confident.

- Cultural Differences: Different cultures have histories and values influencing how they see Trust in finance.

- Class Differences: People's economic backgrounds change how they view and feel about Trust in banks.

- Bank's History: Past financial crises or scandals make people wary.

- Feeling in Control: How well people handle their personal finances may impact their responses on a Trust survey.

- Finance Can Be Confusing: Because the financial world is complex, some might feel unsure, affecting their Trust levels.

- Wanting to Fit In: A standard bias problem in surveys - respondents might answer a survey based on what they think others want to hear, rather than their true feelings.

- Trust Changes Over Time: Trust in banks can vary based on the economy or world events. Answers can change depending on when you ask.

The Optimal Trust acknowledges the multidimensional nature of Trust. It incorporates a framework that captures the nuances of how respondents "trust" the banking system - leading to more accurate and insightful data survey outcomes.

The Optimal Trust Process, Framework, and Technology

The Optimal Trust framework is an innovative, technological approach to understanding and quantifying Trust. The O.T. Technology includes:

- Extensive Lexicon: At the core of this framework is a library of terms and vocabulary associated with the concepts of Trust. This library is more than abstract concepts. It includes a rich tapestry of words representing human emotions, perceptions, and beliefs about Trust and how it operates on all levels within our society.

- Machine Learning Integration: The Optimal Trust software will process vast amounts of data, recognizing subtle differences and shades of meaning. The system will even identify and understand whether a person's response is based on a rational thought or an emotional feeling about Trust. The O.T. Machine Learning (ML) based technology will consistently improve over time, refining its analytical accuracy. Consequently, the data output increasingly mirrors the authentic sentiments and perspectives of our nation's diverse demographic composition.

- Quantification and Categorization: The system converts abstract feelings and thoughts extracted from text-based sentences and documents into quantifiable data. The technology systematically allocates this data into the appropriate "cells" found in the Optimal Trust (O.T.) Grid. Such methodical categorization facilitates a streamlined comprehension of Trust, empowering the OCC and affiliated groups to pinpoint and bolster areas where Trust may be deficient or necessitates improvement.

It will have the capability to read, understand, and organize text-based information in a way that is easy for us to use and benefit from.

Predictive Capabilities of the Optimal Trust (O.T.) Technology:

The O.T. Technology will be capable of integrating with online platforms, encompassing key banking industry databases, consumer-centric metrics, and broad economic indices. Furthermore, the technology will extract information from major news websites, relevant social media channels, and influential blogs.

With these real-time data integration features, O.T. Technology will dynamically update its databases, enabling correlations with the latest information. As the system refines its learning, it will offer real-time contextualization of news and related financial dynamics.

In the long term, this facilitates the prediction of the potential impact of OCC strategies and current events on Trust indices. More importantly, it will forecast how these shifts in human perception influence other facets of the banking system, financial markets, and the economy at large. This predictive insight is invaluable for the Office of the Comptroller of Currency in its efforts to proactively address challenges and harness opportunities within the financial sector.

In implementing this framework, the OCC and others gain a deeper understanding of Trust dynamics, allowing them to foster stronger relationships with stakeholders and optimize their trust-building initiatives.

Benchmarking Trust: Target Metrics & Evaluative Criteria

Benchmarks are pivotal tools for gauging Trust and, more importantly, ensuring the sustained quality and efficacy of financial institutions' trust-related initiatives.

Establishing a series of target metrics provides a clear picture of current performance and a compass pointing toward desired outcomes. These benchmarks are indispensable for financial institutions and their stakeholders, including the OCC, in defining success and ensuring alignment with broader economic and societal goals.

The OCC, along with other regulatory agencies and the financial industry as a whole, possess the necessary metrics to measure and benchmark the effectiveness of any trust-building strategies that are implemented.

Below is a brief list of other relevant metrics that could be utilized that represents a broader perspective on society:

- Consumer-facing Metrics

- Net Promoter Score (NPS): A reflection of customers' likelihood to recommend the bank's services, acting as a proxy for Trust.

- Customer Satisfaction Index: Measures overall contentment with the bank's services, products, and interactions.

- Digital Security and Fraud Incident Reports: Monitoring and addressing incidents can bolster or deteriorate digital Trust.

- Broader Economic Indices

- Consumer Confidence Index: While broader than banking, this metric can provide insights into public Trust in financial institutions as part of the larger economy.

- Banking Sector's Contribution to GDP: A metric showing the relative importance and health of the banking sector in the overall economy.

- Interbank Lending Rates: Reflects the trust banks have in each other's financial stability.

Utilizing these benchmarks, regulatory bodies like the OCC, in collaboration with financial institutions, can tailor strategies to address prevailing challenges. This strategic approach aims to "Optimize Trust" between all stakeholders – fortifying the credibility and resilience of the overall banking system.

Optimizing Trust

Understanding and enhancing consumers' Trust in the banking system is at the heart of the OCC's surveys. The OCC needs advanced analytical tools, transparent objectives, and a rigorous scoring system to leverage this data effectively. Optimal Trust evaluates the efficiency of interventions and data utilization. It prioritizes Optimizing Trust amongst all key stakeholders in the banking ecosystem, ranging from consumers and banks to systemic regulators like the OCC itself.

The foundation of this model rests on the notion that it provides the necessary data to construct roadmaps for addressing problems and, over time, to build Trust and enhance the overall framework upon which the banking system relies.

This knowledge forms the basis for Trust Optimization.

Trust is inherently complex, characterized by numerous variables and measurements. In real-world terms, these various levels of complexity must be balanced. The Optimal Trust (O.T.) framework offers a mechanism to organize economic, regulatory, and financial circumstances that impact the multiple stakeholders in the banking environment.

The first tier of stakeholders includes Consumers/Depositors, Banks and Financial Institutions, and entities like the OCC, Federal Reserve, and other regulatory bodies responsible for overseeing and ensuring the financial system's stability, efficiency, and fairness.

The subsequent tier of stakeholders might include:

- Employees and Personnel: Those who work within the banks and financial institutions, ranging from front-line staff to senior executives.

- Shareholders and Investors: Individuals or entities that hold shares or invest in the banking institutions, both major institutional investors and smaller individual shareholders.

- Third-party Vendors and Service Providers: Organizations or individuals that provide ancillary services, tools, or infrastructure essential for banks to operate, such as technology providers, consultants, and auditors.

- Government and Policymakers: Entities responsible for enacting legislation and policies that can influence the operations of the banking sector and the broader financial system.

- Industry Associations: Groups that represent the collective interests of banks and financial institutions, often playing a role in advocacy, standard-setting, and research.

- Media and Analysts: Those responsible for communicating information about the banking sector to the public and stakeholders, influencing perceptions of Trust.

- International Bodies: Entities like the International Monetary Fund (IMF), World Bank, and Basel Committee on Banking Supervision have roles in global financial stability and set standards that influence domestic banking systems.

- local Communities: Regions or localities where banks operate, and which can be affected by their community outreach, investment, or other operations.

Understanding each stakeholder group's unique perspectives, concerns, and interests is valuable when seeking to Optimize Trust in the overall banking system.

Logistics and Budgetary Limitations… and the Future

In responding to the OCC's RFI, we aim to present a forward-thinking and aspirational blueprint for what the survey can achieve. We aim to design a comprehensive and visionary roadmap, setting innovative goals for what can be accomplished.

While we are fully aware of the logistical and budgetary constraints, we advocate for a future-proof strategy – commencing with practical, initial steps that align with this overarching vision.

Conclusion

At its core, Trust operates within a complex network of relationships. It exists between individuals, between individuals and entities like banks and other financial institutions. It ultimately extends to encompass higher-level institutions representing the financial system at large, such as regulatory bodies and governmental authorities like the Comptroller's Office and the U.S. Treasury.

The Optimal Trust framework serves as a unifying construct. Over time, through ongoing refinement, the framework endeavors to enhance Trust levels across all stakeholders with their competing interests. This process aspires to foster a robust, resilient financial system that thrives under harmonious oversight.

NOTES:

- The Power of and Profitability of Trust was developed in collaboration with Merrill Lynch as external consultants. The copyrights and ownership of the intellectual property reside solely with the authors (Diamond, Silic TXU001743360/2011-3-1).

- The Power of Ethical Trust was developed in collaboration with The Center of Ethics at St. Thomas University. Miami Gardens, Fl., the copyrights and ownership of the intellectual property reside solely with the author (Diamond TXU002103513/2018-06-21).

- As we developed our response to the OCC's Request for Information (RFI) on banking trust, we acknowledged the scholarly research highlighted in the RFI. Recognizing that the OCC has already endorsed these studies, we are confident in their validity to underpin our arguments. While terminologies might differ across publications and from our phrasing, the essential elements are consistent and underscore the multifaceted nature of Trust: (While the OCC identifies four components, we delineate six. We outlined six components to provide choice and adaptability based on context. We also recognize that numerous synonyms exist for each component and their antonyms or negative counterparts. We also refer to the distinctions between the Rational and Emotional aspects as "Dimensions.")

- Though the terms may vary, distinctions between Individual, Organizational (group), and Global (meta-group) levels are universally recognized across many fields, including psychology, sociology, anthropology, and economics. (Neal M. Ashkanasy and Alana D. Dorris (2017) “Organizational Behavior”, Oxford Research Encylcopedia)

- Emotionally, our relationship with money is deeply personal. Banks inherently evoke strong feelings as the primary institutions that handle our money. Trust in banks is essential; after all, we entrust them with our hard-earned savings, our dreams of homeownership, or the capital to start a new business. Conversely, a breach of this Trust, such as a banking crisis, can elicit powerful emotions of fear or betrayal. Money and banking are inextricably intertwined, both intellectually and emotionally.

- Jiang, Y., Chen, Z., & Wyer, R. S., Jr. (2014). Impact of money on emotional expression.Journal of Experimental Social Psychology, 55, 228–233. https://doi.org/10.1016/j.jesp.2014.07.013

- Activating the concept of money can influence people's own expressions of emotion as well as their reactions to the emotional expressions of others. Thinking about money increases individuals' disposition to perceive themselves in a business-like relationship with others in which transactions are based on objective criteria and the expression of emotion is considered inappropriate. Therefore, these individuals express less emotion in public and expect others to do likewise. Six experiments show that subtle reminders of money lead people to have more negative attitudes toward expressing emotions in public and to avoid expressing emotion in their written communications. In addition, money-primed participants judge others' emotions to be more extreme and are disposed to avoid interacting with persons who display these emotions.

- Shane Enete, Martin Seay, Sarah Asebedo, David Wang,d and Megan McCoy (2022), Personal Emotions and Family Financial Well-Being: Applying the Broaden and Build Theory Journal of Financial Counseling and Planning, Volume 33, Number 1, 2022, 79–96, Association for Financial Counseling and Planning Education http://doi.org/10.1891/JFCP-20-00030 https://files.eric.ed.gov/fulltext/EJ1347074.pdf

- Paul K. Piff and Jake P. Moskowitz, Wealth, Poverty, and Happiness: Social Class Is Differentially Associated With Positive Emotions Wealth, Poverty, and Happiness (apa.org) American Psychological Association, 2017, 1528-3542/18/$12.00 http://dx.doi.org/10.1037/emo0000387, Wealth, Poverty, and Happiness (apa.org)

- Jiang, Y., Chen, Z., & Wyer, R. S., Jr. (2014). Impact of money on emotional expression.Journal of Experimental Social Psychology, 55, 228–233. https://doi.org/10.1016/j.jesp.2014.07.013

2023 © OPTIMAL TRUST

AllRights Reserved