Trust Q Executive Brief:

United States Attack on Venezuela

January 4-6, 2026

Beyond Regime Change: The Trust Breakdown Behind the U.S.–Venezuela Crisis

The relationship between the United States and Venezuela crossed a threshold that materially alters enterprise risk, energy markets, and the operating assumptions behind contracts, compliance, and capital deployment across the Western Hemisphere. The U.S. operation that resulted in the capture of Venezuelan President Nicolás Maduro and the immediate paralysis of Venezuelan oil exports is not a conventional geopolitical shock. It is a trust rupture at the system level—raising questions of legality, enforceability, and precedent that markets and institutions must now price. This briefing applies the Optimal Trust framework to help C-suite leaders understand where predictability has broken down, which risks are transient versus structural, and what signals would meaningfully reduce uncertainty for business decision-making.

Advisory Note: This analysis is for informational purposes only

and does not constitute investment, legal, or tax advice.

Please see the full Legal Disclaimer at the end of this article.

TRUSTQ Executive Brief — January 4–6, 2026

Trust Rupture in the Hemisphere: U.S.–Venezuela shock, oil disruption, and board-level exposure

What happened (confirmed)

-

Reuters reports the U.S. conducted a major operation that captured Venezuelan President Nicolás Maduro and brought him to the U.S. to face criminal charges; the administration framed it as law enforcement tied to indictments, while legal experts questioned the action’s legality under international law. Reuters+1

-

Reuters also reports Venezuela’s oil exports were paralyzed immediately afterward, with port authorizations not being issued and storage constraints raising the prospect of forced production cuts. Reuters+1

-

In the days following, Reuters reports at least some flows resumed in irregular form: Chevron resumed exports after a brief pause, while sanctioned vessels reportedly departed “dark” toward Asia. Reuters+1

Executive takeaway: This is a sovereignty + legality + energy logistics event. The operational shock is immediate; the governance and legal overhang may persist.

What markets are actually pricing

-

Energy logistics risk premium (barrels stuck > barrels in reserve) Reuters+1

-

Rules/precedent risk (integrity of the hemispheric order; spillover into broader EM risk premia) Reuters+1

-

Compliance/contract enforceability risk (title, custody, sanctions, insurance, payment rails)

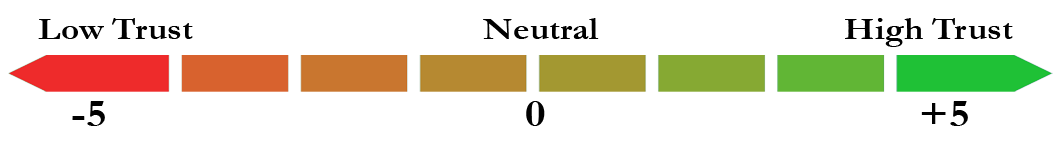

Optimal Trust Grid (36 cells, -5 to +5)

This scoring reflects system trust conditions now: predictability, enforceability, legitimacy, and emotional acceptance.

Why these scores are where they are (the “OT diagnosis”)

- Integrity is the crater. A forced capture + talk of the U.S. “running” Venezuela creates maximum dispute over legitimacy and rules—especially internationally. (Reuters)

- Aligned Interests are negative at every level. The U.S. frames law-enforcement/national interest; Venezuelan regime loyalists frame sovereignty/occupation. Regional actors split hard. (Reuters)

- Competency is only mildly negative because the operation succeeded tactically—but governance competence and oil-restart competence are open questions and likely slow. (Reuters)

- Communications are degraded: competing narratives, fast-changing policy statements, and unclear “next governance” roadmap. (Reuters)

+ For a detailed breakdown of the scoring, see APPENDIX 1 at the end of this article.

Enterprise impact: what the C-suite should care about

1) Energy, feedstocks, and cost structure

-

You are not pricing “Venezuela the country.” You are pricing flow interruption + uncertainty. Reuters: exports halted; storage constraints imply production cuts. Reuters+1

-

Short-term: higher volatility in crude and refined product differentials; medium-term depends on licensing/custody architecture and political stabilization.

Board question: What’s our sensitivity to a 5–15% move in energy inputs over 30–90 days?

2) Contract enforceability and counterparty risk

Where trust breaks first is not diplomacy—it’s paperwork:

-

Title risk (who has authority to sell/ship?)

-

Payment risk (sanctions, blocked accounts)

-

Force majeure disputes

-

Insurance exclusions

Reuters’ reporting of irregular shipping (“dark mode”) is a clear warning sign for compliance posture. Reuters+1

Board question: Do we have any suppliers, agents, or customers whose exposure routes through Venezuelan-origin cargoes, intermediaries, or “grey” shipping?

3) Sanctions, compliance, and legal exposure

-

Chevron’s carve-out underscores that licenses and exemptions can determine winners/losers independent of market prices. Reuters+1

-

Legal controversy is now part of the operating environment; litigation and political risk can attach to deals even when economically rational. Reuters+1

Board question: Are we prepared for a scenario where guidance changes quickly (licenses tighten/expand, enforcement steps up, reputational scrutiny increases)?

4) People, security, and reputational risk

The emotional trust collapse (Meta-group E ~ -4) is a proxy for:

-

employee concerns (especially in LatAm)

-

stakeholder polarization

-

activism campaigns, procurement scrutiny, and reputational blowback

UN human-rights warnings and international backlash amplify reputational sensitivity. Reuters

Scenario map (C-suite version)

Scenario A — Stabilization + written custody/authority (30%)

Oil and payments normalize under a transitional framework; volatility fades.

Scenario B — Contested transition + “grey flows” (50%) (base case)

Irregular shipments, patchwork licensing, persistent legal disputes; risk premium stays embedded. Reuters+1

Scenario C — Escalation / enforcement spiral (20%)

Broader sanctions, seizures, military threats; insurance and shipping costs spike; EM risk reprices.

Executive actions (48 hours / 30 days)

In 48 hours

-

Exposure scan: energy inputs, LatAm operations, shipping lanes, intermediaries

-

Contract review: force majeure language, sanction clauses, termination rights

-

Compliance bulletin: remind business units about Venezuelan-origin cargo diligence; no “creative routing”

In 30 days

-

Build a Venezuela risk dashboard: licensing status, shipping signals, insurance premia, diplomatic posture

-

Run a cost shock drill on energy + freight

-

Prepare stakeholder messaging (employees, investors, customers) focused on safety, legality, and continuity

Three trust-repair levers (what would actually de-risk the enterprise)

-

Verifiable legal process (reduces precedent risk) Reuters+1

-

Written custody/authority for oil revenues & exports (fixes the transaction layer) Reuters+1

-

Multilateralized transition narrative (reduces backlash and reputational risk) Reuters

APPENDIX 1

Optimal Trust Grid

U.S.–Venezuela Crisis (January 2026)

Scale: –5 (severe trust breakdown) to +5 (strong trust)

Aligned Interests

Individual Level

Rational: –2

The Trump administration’s stated objectives (law enforcement, regime removal, strategic leverage) and Maduro’s objectives (regime survival, sovereignty, personal protection) are fundamentally opposed. Temporary overlap does not exist.

Emotional: –3

Personal animosity, humiliation, and perceived existential threat dominate. Any residual emotional alignment is extinguished by the nature of the capture.

Group / Institutional Level

Rational: –3

U.S. institutions are acting to dismantle the existing Venezuelan power structure, while Venezuelan state actors (military, PDVSA remnants, loyalists) are incentivized to resist, delay, or sabotage cooperation.

Emotional: –4

Within Venezuela, the event is widely framed as coercion or invasion; within parts of the U.S. system, Venezuela is framed as illegitimate or criminal. Emotional zero-sum thinking prevails.

Meta-Group / Global Level

Rational: –2

Some global actors share an abstract interest in stability and oil flow, but disagree sharply on methods and precedent. Alignment exists in theory, not execution.

Emotional: –3

The episode triggers long-standing fears about interventionism, colonial patterns, and sovereignty violations—especially in the Global South.

Communications

Individual Level

Rational: –2

Communication is indirect, mediated through press statements, indictments, and proxies. There is no functioning bilateral dialogue.

Emotional: –3

Messages are interpreted through fear, anger, and triumphalism, not mutual understanding.

Group / Institutional Level

Rational: –3

Multiple authorities speak at once (White House, DOJ, Pentagon, Treasury, regional governments), creating ambiguity about control, timelines, and next steps.

Emotional: –3

Conflicting narratives heighten anxiety and mistrust among institutions, investors, and populations.

Meta-Group / Global Level

Rational: –2

International messaging lacks a unified framework (law enforcement vs. military action vs. transitional governance), weakening clarity.

Emotional: –3

Global audiences split emotionally—some view the move as overdue justice, others as destabilizing force—polarization dominates.

Competency

Individual Level

Rational: –1

The operation itself demonstrates tactical capability, but provides no evidence yet of strategic competence in managing aftermath, governance, or economic normalization.

Emotional: –1

Confidence is cautious rather than panicked; observers acknowledge execution skill but question follow-through.

Group / Institutional Level

Rational: –2

Institutions appear unprepared for immediate consequences: halted oil exports, unclear port authority, and governance vacuum.

Emotional: –2

Markets and regional actors express unease about institutional readiness for second- and third-order effects.

Meta-Group / Global Level

Rational: –1

The international system has tools (sanctions relief, stabilization missions, financial oversight) but no agreed playbook for this scenario.

Emotional: –1

Skepticism outweighs confidence, but this is not yet seen as total incompetence.

Integrity

Individual Level

Rational: –3

The capture of a sitting head of state raises serious questions about legality, jurisdiction, and due process under international norms.

Emotional: –4

Perceived humiliation and betrayal dominate emotional responses, particularly in Venezuela and sympathetic states.

Group / Institutional Level

Rational: –4

Rules-based predictability is severely weakened: who has authority over assets, oil revenues, ports, and contracts is unclear.

Emotional: –4

Institutions assume bad faith from opposing sides; trust collapses rather than erodes.

Meta-Group / Global Level

Rational: –3

Precedent risk is high. Even allies worry about where the line is drawn and whether similar actions could be taken elsewhere.

Emotional: –4

Collective memory of intervention fuels resentment and fear, especially among non-aligned states.

Intentions

Individual Level

Rational: –2

The U.S. signals intent to “restore order” or “enable transition,” but offers no concrete, time-bound roadmap. Intentions are opaque.

Emotional: –3

Intent is emotionally read as punitive or dominating rather than stabilizing.

Group / Institutional Level

Rational: –3

Competing institutional goals (justice, deterrence, oil access, regional signaling) dilute perceived coherence of intent.

Emotional: –3

Fear of hidden agendas—resource capture, political messaging, or regime engineering—dominates perception.

Meta-Group / Global Level

Rational: –2

Some international actors see potential for stabilization; others see intent as unilateral power projection.

Emotional: –3

Global confidence in benign intent is low, even where outcomes might be welcomed.

Shared Values

Individual Level

Rational: –3

Leaders operate from incompatible value systems: rule-of-law enforcement vs. sovereignty and resistance.

Emotional: –4

There is virtually no emotional resonance or empathy across leadership narratives.

Group / Institutional Level

Rational: –3

Institutions disagree on core values: legality, democracy promotion, non-intervention, and economic control.

Emotional: –4

Cultural memory and ideological framing override any sense of shared norms.

Meta-Group / Global Level

Rational: –2

Minimal overlap exists around humanitarian relief and economic stabilization—but not on means.

Emotional: –3

Trust in a shared moral framework is weak and fractured.

Bottom-Line Trust Diagnosis (Advisor Summary)

- Primary rupture: Integrity + Communications

- Primary market transmission: Energy logistics → EM risk premium → political precedent

- Trust posture:

- Rational trust: Fragile but not collapsed

- Emotional trust: Severely impaired

This is why markets may remain volatile even if oil prices stabilize—the trust damage sits deeper than price alone.

Legal Disclaimer

This TrustQ Newsfeed content is provided for informational and educational purposes only and does not constitute investment advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security, commodity, or financial instrument.

The analysis presented herein reflects an Optimal Trust (OT) framework–based interpretation of publicly available information as of the date of publication. It is intended to help financial advisors contextualize geopolitical and market developments and support informed client conversations. It does not represent a prediction, guarantee, or definitive assessment of future events or market performance.

All market scenarios, probability-weighted outcomes, sector impacts, and trust scores are illustrative, not forecasts. Actual outcomes may differ materially due to changes in political decisions, legal rulings, regulatory actions, military developments, market conditions, or other unforeseen factors.

This content should not be relied upon as a primary basis for investment decisions. Financial advisors should conduct their own independent analysis, consider client-specific objectives, risk tolerance, and circumstances, and consult appropriate compliance, legal, or investment professionals before making any recommendations or portfolio adjustments.

References to specific countries, leaders, companies, sectors, or markets are made solely for analytical purposes and do not imply endorsement, condemnation, or factual certainty beyond what is reported by cited public sources. Information derived from news reporting is subject to revision as events evolve.

Neither Optimal Trust, TrustQ, nor the authors or contributors assume any responsibility for errors, omissions, or subsequent developments, nor for any losses or damages arising from the use of this material.

Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

T Terms of Use Disclaimer Privacy Policy Contact Us

For more info call: (347)-474-8090

Copyright 2025, All Rights Reserved

© Copyright OPTIMAL TRUST