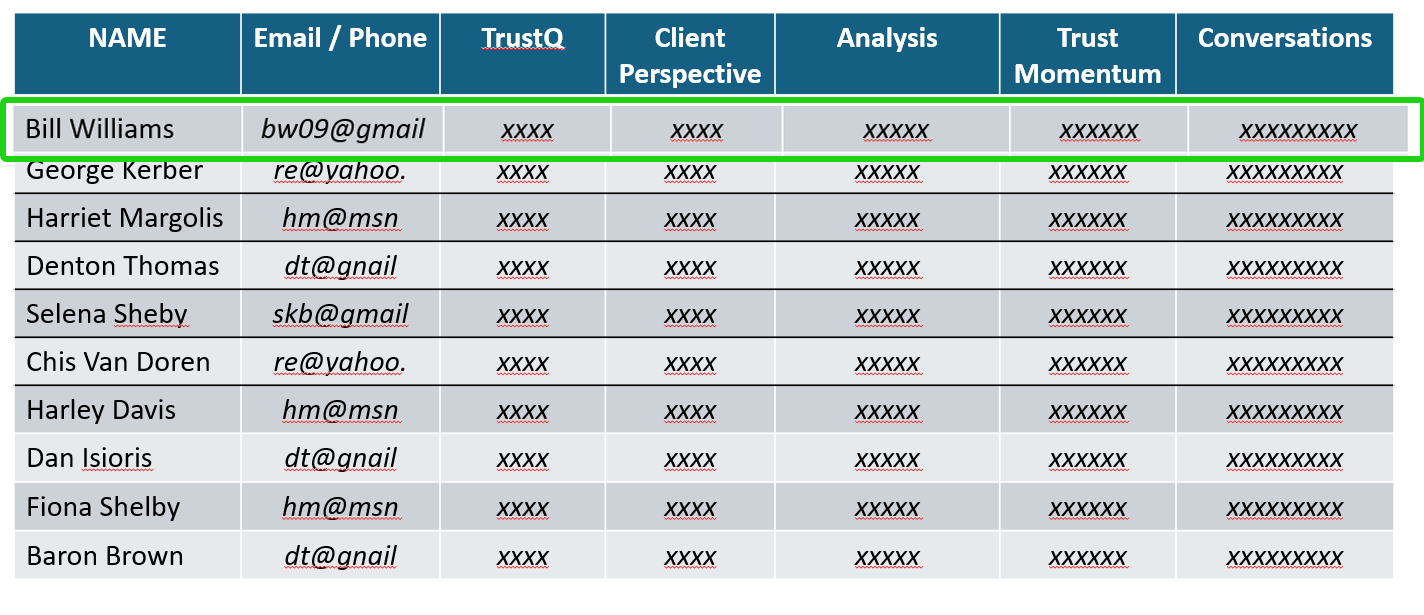

TRUST Q PROFILES: Your Clients

Bill Williams OPTIMAL TRUST PROFILE (Summary)

Bill’s Financial Trust Profile (His "Financial Intuition")

🔹 Integrity → Bill values ethical behavior, transparency, and trustworthiness above all else.

- He needs to feel confident that his FA, the firm, and the industry are operating honestly and in his best interest.

- Any hint of hidden fees, conflicts of interest, or misleading information will erode his trust quickly.

🔻 Emotional Trust → Bill struggles to fully trust based on feelings and prefers logical validation.

- He has difficulty trusting based on gut instincts or personal rapport alone.

- He needs evidence, numbers, and clear reasoning to feel secure in financial decisions.

- Most Trusted Dimension:

✅ Rational Trust → Bill places the most trust in facts, logic, and well-supported explanations.

- He responds well to historical market data, risk assessments, and structured plans.

- He values competence and expertise but still questions industry incentives.

- Trust Scores Summary:

📊 Rational Trust Score: 1.83 (Moderate Trust)

📊 Emotional Trust Score: 0.56 (Weak Trust)

Key Insights About Bill’s Financial Intuition

- He is a data-driven decision-maker. He needs clear, factual explanations to feel confident in financial decisions.

- He is skeptical of financial institutions. He believes in investing but questions industry ethics.

- He struggles with emotional reassurance. Simply saying “trust me” or offering general positivity won’t work.

- He needs integrity-proof. He will demand transparency, honesty, and ethical conduct before fully trusting any financial entity.

How to Use This Profile

🔹 For Financial Advisors (FA):

- Approach Bill with transparency first. Clearly explain how decisions are made and how fees work.

- Balance rational data with emotional reassurance. He trusts numbers but still needs to feel understood.

- Acknowledge industry trust issues. Address his skepticism about the financial system early.

🔹 For Financial Organizations (Group Trust):

- Communicate firm-wide transparency policies. Bill will trust the firm more if it openly discusses how it makes money.

- Reinforce fiduciary responsibility. Make it clear that the firm’s incentives align with client success.

🔹 For the Financial Industry (Meta Trust):

- Address broader skepticism head-on. The industry’s reputation is a major factor in Bill’s hesitation.

- Simplify financial communication. Reduce jargon and make investing feel accessible rather than intimidating.

Final Takeaway:

Bill’s Financial Intuition is heavily rational and ethics-driven. He will trust advisors and firms that prioritize transparency, logic, and honesty—while still addressing his underlying emotional concerns.

Bill Williams OPTIMAL TRUST Detailed View

We'll examine how trust is built or weakened at:

- Individual Level (Bill / Karen)

- Group Level (The Firm / Financial Institution)

- Meta Level (Trust in the Industry as a Whole

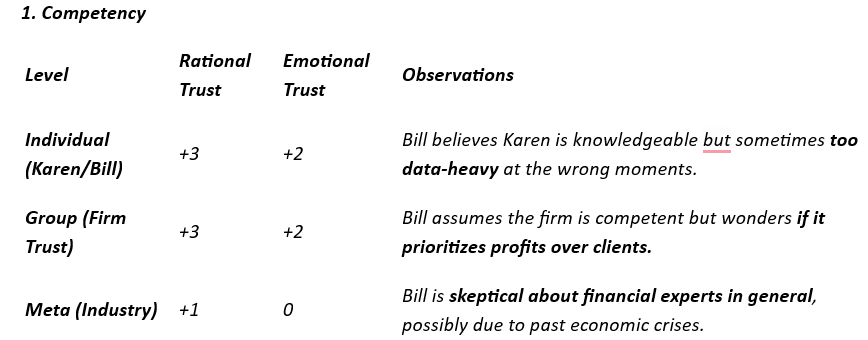

COMPETENCY

Key Areas for Improvement

Firm-Level:

- Reinforce the firm’s commitment to unbiased advice. Bill may worry that advisors are pressured to sell firm-approved products.

- Karen could say: “One of the reasons I work at this firm is because we are not commission-driven. Our priority is aligning with your best interests.”

Industry-Level:

- Address industry skepticism early. Bill may have seen financial institutions fail before (2008, scandals, market crashes).

- Karen could acknowledge: “I know trust in the financial world has taken hits in the past. That’s why I make it a priority to always be transparent with you.”

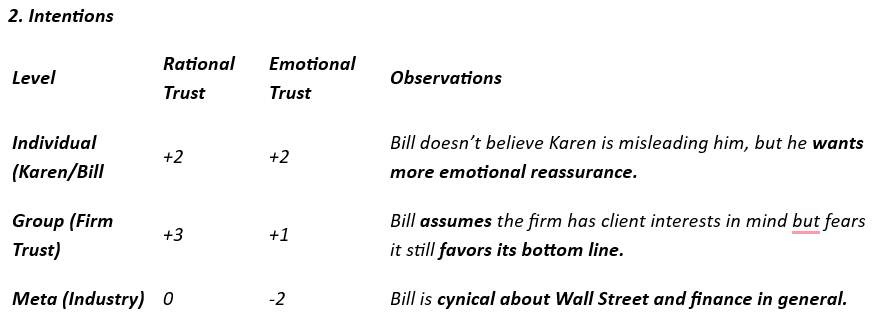

INTENTIONS

Key Areas for Improvement

Firm-Level:

- Make the firm’s fiduciary role explicit.

- Example: “Our firm is legally bound to act in your best interest, and we take that seriously.”

Industry-Level:

- Address negative perceptions about financial institutions.

- Bill may assume the system is “rigged” for the rich. Karen could address this head-on:

- “I completely understand why many people feel that the industry isn’t always fair. That’s why my goal is to cut through the noise and make sure you get advice tailored to you, not just generic market trends.”

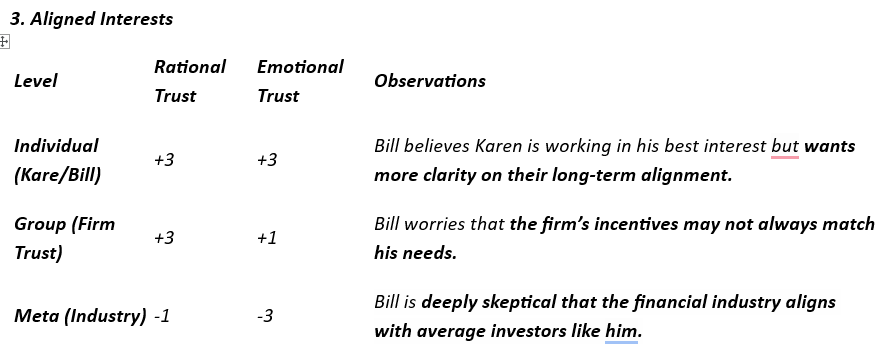

ALLIGNED INTERESTS

Key Areas for Improvement

Firm-Level:

- Explain how firm compensation structures align with clients.

- Example: “We don’t make more money if you take unnecessary risks. We succeed when you succeed.”

Industry-Level:

- Acknowledge distrust in financial systems.

- Example: “You’re right to question incentives in this industry. That’s why I always focus on long-term, client-first planning.”

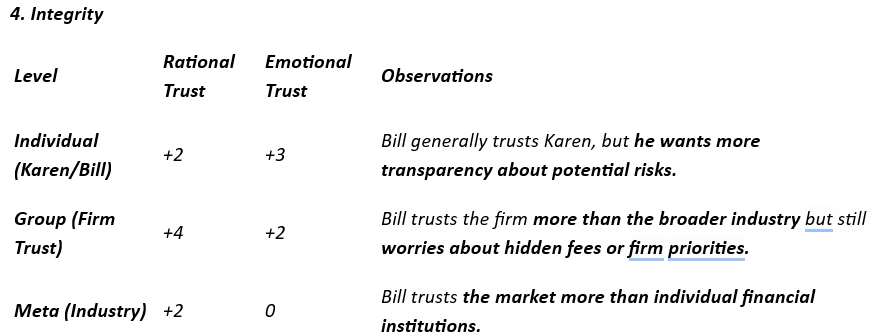

INTEGRITY

Key Areas for Improvement

Firm-Level:

- Proactively discuss how fees work. Even if Bill hasn’t asked about fees, his skepticism suggests he’s wondering.

- Example: “Bill, I always want to be upfront—here’s exactly how our firm makes money so you never have to wonder.”

Industry-Level:

- Reinforce why investing still works despite industry flaws.

- Example: “Yes, there are bad actors in finance, but smart investing strategies have helped millions of people retire securely.”

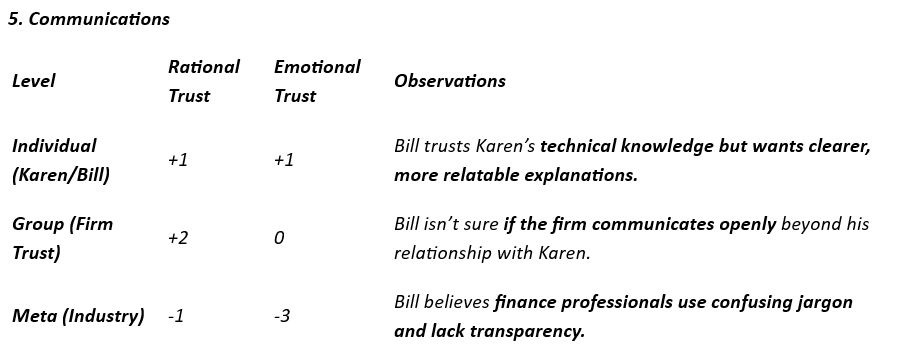

COMMUNICATIONS

Key Areas for Improvement

Firm-Level:

- Ensure firm-wide communication is strong.

- Example: “If you ever need anything beyond our meetings, our firm’s client portal is a great resource to track your accounts clearly.”

Industry-Level:

- Combat financial jargon and complexity.

- Karen should frame investments in plain English, without overloading Bill with technical terms.

- Example: Instead of “Your portfolio is diversified across multiple asset classes,”

- Say: “Your money is spread out across different types of investments so no single downturn can hit you too hard.”

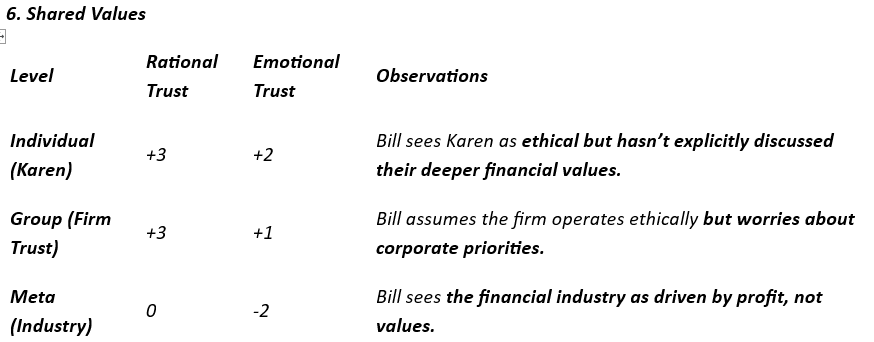

SHARED VALUES

Key Areas for Improvement

Firm-Level:

- Discuss how the firm supports ethical investing. If Bill cares about ESG (Environmental, Social, Governance) investing, Karen should ask:

- “Bill, would you be interested in investments that align with your values—like socially responsible or ESG-focused funds?”

Industry-Level:

- Acknowledge broader financial ethics concerns.

- Example: “I know that many financial institutions prioritize profits over people, but that’s exactly why I focus on trust, transparency, and making sure my clients feel heard.”

Final Takeaways

- Bill generally trusts Karen but wants more reassurance and emotional intelligence in conversations.

- Bill is skeptical of the financial firm’s incentives and wants more clarity about how it profits.

- Bill has low industry trust—he believes the financial world is rigged against regular investors.

Bill’s Financial Trust Profile (His "Financial Intuition")

- Most Important Trust Characteristic:

🔹 Integrity → Bill values ethical behavior, transparency, and trustworthiness above all else.

- He needs to feel confident that his FA, the firm, and the industry are operating honestly and in his best interest.

- Any hint of hidden fees, conflicts of interest, or misleading information will erode his trust quickly.

- Least Trusted Dimension:

🔻 Emotional Trust → Bill struggles to fully trust based on feelings and prefers logical validation.

- He has difficulty trusting based on gut instincts or personal rapport alone.

- He needs evidence, numbers, and clear reasoning to feel secure in financial decisions.

- Most Trusted Dimension:

✅ Rational Trust → Bill places the most trust in facts, logic, and well-supported explanations.

- He responds well to historical market data, risk assessments, and structured plans.

- He values competence and expertise but still questions industry incentives.

- Trust Scores Summary:

📊 Rational Trust Score: 1.83 (Moderate Trust)

📊 Emotional Trust Score: 0.56 (Weak Trust)

Key Insights About Bill’s Financial Intuition

- He is a data-driven decision-maker. He needs clear, factual explanations to feel confident in financial decisions.

- He is skeptical of financial institutions. He believes in investing but questions industry ethics.

- He struggles with emotional reassurance. Simply saying “trust me” or offering general positivity won’t work.

- He needs integrity-proof. He will demand transparency, honesty, and ethical conduct before fully trusting any financial entity.

How to Use This Profile

🔹 For Financial Advisors (FA):

- Approach Bill with transparency first. Clearly explain how decisions are made and how fees work.

- Balance rational data with emotional reassurance. He trusts numbers but still needs to feel understood.

- Acknowledge industry trust issues. Address his skepticism about the financial system early.

🔹 For Financial Organizations (Group Trust):

- Communicate firm-wide transparency policies. Bill will trust the firm more if it openly discusses how it makes money.

- Reinforce fiduciary responsibility. Make it clear that the firm’s incentives align with client success.

🔹 For the Financial Industry (Meta Trust):

- Address broader skepticism head-on. The industry’s reputation is a major factor in Bill’s hesitation.

- Simplify financial communication. Reduce jargon and make investing feel accessible rather than intimidating.

Final Takeaway:

Bill’s Financial Intuition is heavily rational and ethics-driven. He will trust advisors and firms that prioritize transparency, logic, and honesty—while still addressing his underlying emotional concerns.

Conversation 1: Retirement Anxiety & Market Jitters

Conversation 1: Retirement Anxiety & Market Jitters

Setting:

Bill, a middle-aged investor, is meeting with Karen, his financial advisor, to discuss his financial future. While Bill trusts Karen’s expertise, he often feels overwhelmed by complex financial discussions and remains skeptical of the industry’s transparency. Karen, however, tends to focus heavily on data, sometimes missing Bill’s need for reassurance and trust-building.

Client (Bill, 61):

Hey, Karen. Thanks for taking the time. I, uh… I feel like I’m screwing this up. I checked my retirement account again this morning, and, I mean, it’s just—down. Again. Every time I open it, I swear it’s worse. I don’t even wanna look anymore.

Advisor (Karen):

Hey, Bill. I hear you. The market’s been really choppy lately, and I know that can be unsettling. But before we go too far down the rabbit hole—how often are you checking your account?

Client:

Honestly? Every day. Sometimes multiple times a day. I just can’t help it. It’s like this obsessive thing where I keep hoping it’ll be back up, but it’s always the same story.

Advisor:

That makes sense. It’s hard not to look when you feel like your future is on the line. But here’s the thing—checking every day is kinda like weighing yourself every hour when you’re on a diet. The fluctuations don’t mean much in the short term, but they can drive you crazy.

Client:

Yeah, but the numbers don’t lie, Karen. I mean, I’m watching my savings shrink. This isn’t just some psychological thing—it’s real money disappearing.

Advisor:

Totally get that. Let’s break it down. When was the last time you looked at your account before this recent stretch?

Client:

Uh… I don’t know, maybe six months ago? It was a lot higher then.

Advisor:

Right. So let’s take a step back. If we go back five years—do you remember what your balance was in, say, 2019?

Client:

I think… somewhere around $750,000?

Advisor:

Right. And today, even after this pullback, where are you sitting?

Client:

Around $1.1 million.

Advisor:

So even after this drop, you’re still up significantly over the last five years. And remember, that’s including a global pandemic and a couple of market corrections.

Client:

Yeah, I get that, but it feels different now. I’m not 40 anymore, Karen. I don’t have 20 years to wait for it to bounce back.

Advisor:

Totally fair. But let’s look at the bigger picture. The part of your portfolio that’s down is mainly stocks, right? Your bonds are holding steady.

Client:

Yeah, but the stocks are the ones that are supposed to make me money, right?

Advisor:

Well, they’re supposed to grow over time, yes. But they also go through cycles. If we zoom out, every major downturn has eventually recovered. The people who get hurt the most are the ones who panic and sell at the bottom.

Client:

Yeah, but what if this is the one time it doesn’t bounce back? What if the market just stays bad for years?

Advisor:

It’s a fair question. Let’s game it out. Worst-case scenario, let’s say the market stays flat or negative for, say, five years. What would that look like for you?

Client:

I don’t know. I guess I’d have to start withdrawing money sooner than I planned.

Advisor:

Right, and that’s why we built your cash reserves. You’ve got, what—$100,000 in a money market account and another $50,000 in short-term bonds?

Client:

Yeah, somewhere around there.

Advisor:

Okay, so that means, even in the absolute worst-case scenario where the market doesn’t recover for five years, you could still cover your expenses for a good chunk of time without selling stocks at a loss.

Client:

But that assumes inflation doesn’t eat that away.

Advisor:

True, but that’s why we don’t want to abandon stocks entirely. They’re your best hedge against inflation over the long run.

Client:

So what am I supposed to do? Just sit here and watch my balance keep dropping?

Advisor:

Not necessarily. We can make adjustments if this is keeping you up at night. We could rebalance a little—shift some of your stocks into more defensive sectors or dividend-paying funds. But selling everything now and going to cash would lock in losses.

Client:

I get that. But, Karen, I’m losing sleep over this. Like, I wake up thinking about it.

Advisor:

That’s really important to acknowledge. I don’t want you feeling that way. If your stress level is this high, maybe we need to adjust your risk exposure, even if it means slightly lower returns over time. Your peace of mind matters too.

Client:

Yeah, but then I feel like I’d be giving up potential gains if the market does rebound.

Advisor:

That’s the tricky part—balancing peace of mind with long-term growth. If I told you that shifting, say, 10% more into bonds would cut your potential downside risk, but also lower your long-term returns by a couple of percentage points, how would you feel about that tradeoff?

Client:

Honestly? I don’t know. It’s like, every option has a downside.

Advisor:

That’s the nature of investing—there’s no perfect solution, only tradeoffs. Maybe what we do first is just put some guardrails in place so you’re not checking your account every day. How about we set up a system where you only review it once a month?

Client:

I don’t know if I have the willpower for that.

Advisor:

Okay, what if we just automate a report that gets emailed to you once a month with a high-level view, no daily fluctuations?

Client:

That might help. But what if the market really crashes? Like 2008-style?

Advisor:

Then we adjust. But we don’t react emotionally. We follow the plan we built. We’d shift withdrawals, tighten up spending, maybe rebalance. You’re not on your own in this, Bill.

Client:

That actually makes me feel a little better.

Advisor:

Good. Because this is exactly why we plan ahead—so you don’t have to panic when the market does what it always does.

Client:

Okay. I think I just needed to hear that I’m not crazy for feeling this way.

Advisor:

You’re not crazy at all. This is your life savings—it’s natural to feel protective of it. But the key is managing it wisely, not emotionally.

Client:

Yeah. Alright, let’s check in again next month. Maybe that’ll help me stay sane.

Advisor:

Absolutely. And if things start feeling overwhelming again before then, just shoot me an email.

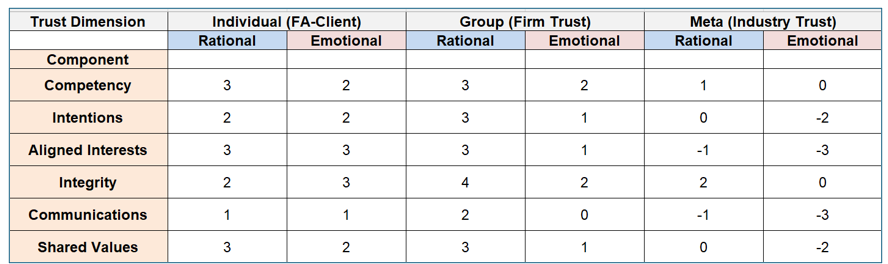

APPENDIX 1 - How We Derived Insights from Bill’s Trust Assessment Grid

APPENDIX 1 - How We Derived Insights from Bill’s Trust Assessment Grid

Using Bill’s Trust Assessment Grid to break down specific examples of how Karen’s interaction with Bill led to his trust scores and how we used that data to form actionable recommendations.

Example 1: Competency (FA-Client)

📊 Trust Scores:

- Rational Trust (Individual FA-Client Level): +3

- Emotional Trust (Individual FA-Client Level): +2

🔎 What This Means:

- Bill trusts Karen’s technical skills (Rational +3) because she provided detailed explanations about market cycles and his portfolio strategy.

- However, he still feels a little uncertain emotionally (Emotional +2), because she overwhelmed him with data instead of reassuring him first.

✅ How We Translated This into Feedback for Karen:

- Strengths: Karen explained the market well and helped Bill understand his investment position.

- Where She Went Wrong: She jumped into numbers too soon before addressing Bill’s anxiety.

- Improvement Suggestion:

- Instead of: “Markets tend to recover in 5 years,”

- Say: “Bill, I hear you. I know it’s scary to watch your balance go down. Let’s talk about how your portfolio is built to weather downturns.”

- Why? This small change validates his emotions first, then introduces logic.

Example 2: Integrity (Financial Firm)

📊 Trust Scores:

- Rational Trust (Firm Level): +4

- Emotional Trust (Firm Level): +2

🔎 What This Means:

- Bill believes the firm operates ethically in a structured, rules-based way (Rational +4).

- However, he is not fully convinced emotionally (Emotional +2), likely because he worries that firms prioritize profits over people.

✅ How We Translated This into Feedback for Karen:

- Strengths: Bill trusts the firm’s rules and compliance standards.

- Where He Hesitates: He wonders if the firm might still act in its own best interest.

- Improvement Suggestion:

- Instead of: “Our firm always acts in your best interest.”

- Say: “Bill, I understand that a lot of people feel financial firms care more about their own bottom line. That’s why we have strict fiduciary standards—we succeed when you succeed.”

- Why? Bill needs to hear that Karen acknowledges public skepticism rather than dismissing it outright.

Example 3: Aligned Interests (Industry Level)

📊 Trust Scores:

- Rational Trust (Industry Level): -1

- Emotional Trust (Industry Level): -3

🔎 What This Means:

- Bill is skeptical of the financial industry at large.

- While he logically believes that investing can work (-1 Rational), he emotionally distrusts the financial sector (-3 Emotional), likely due to past financial crises, scandals, or concerns about Wall Street.

✅ How We Translated This into Feedback for Karen:

- Strengths: Karen doesn’t need to convince Bill that investing works—he already accepts that rationally.

- Where He Hesitates: He doesn’t trust the system itself and feels like regular investors get the short end of the stick.

- Improvement Suggestion:

- Instead of: “The market has always recovered.”

- Say: “Bill, I completely understand why many people feel the financial system is built for the wealthy. That’s exactly why I focus on making sure my clients understand how to protect themselves and take control.”

- Why? This frames Karen as Bill’s advocate, helping him navigate an industry he distrusts.

Example 4: Communications (Firm & Industry Level)

📊 Trust Scores:

- Rational Trust (Firm Level): +2

- Emotional Trust (Firm Level): 0

- Rational Trust (Industry Level): -1

- Emotional Trust (Industry Level): -3

🔎 What This Means:

- Bill somewhat trusts the firm’s ability to communicate financial matters (+2 Rational), but he doesn’t feel emotionally connected to it (0 Emotional).

- His trust in industry-wide communication is much worse—he believes finance professionals use too much jargon (-1 Rational) and lack transparency (-3 Emotional).

✅ How We Translated This into Feedback for Karen:

- Strengths: Karen explains finance well on a technical level.

- Where She Went Wrong: She failed to simplify her explanations and missed an opportunity to make the conversation feel personal.

- Improvement Suggestion:

- Instead of: “Your portfolio is diversified across asset classes.”

- Say: “Your money is spread across different investments so that no single bad year can throw off your retirement plan.”

- Why? Bill wants clarity without jargon. Making the information feel personal and relevant to him will strengthen his trust.

Final Takeaways: How We Used the Grid to Generate Feedback

- We mapped each trust characteristic (Competency, Integrity, Communications, etc.) to Bill’s trust levels at the Individual, Firm, and Industry levels (Rational and Emotional).

- We analyzed where trust was weak and why—for example, Bill trusts Karen’s knowledge but feels emotionally disconnected from the firm.

- We provided targeted recommendations based on Bill’s needs—for example, simplifying language, validating emotions before logic, and addressing skepticism about the industry.

© Copyright OPTIMAL TRUST