YOUR PERSOANL TRUST Q PROFILE: Karen Tennen

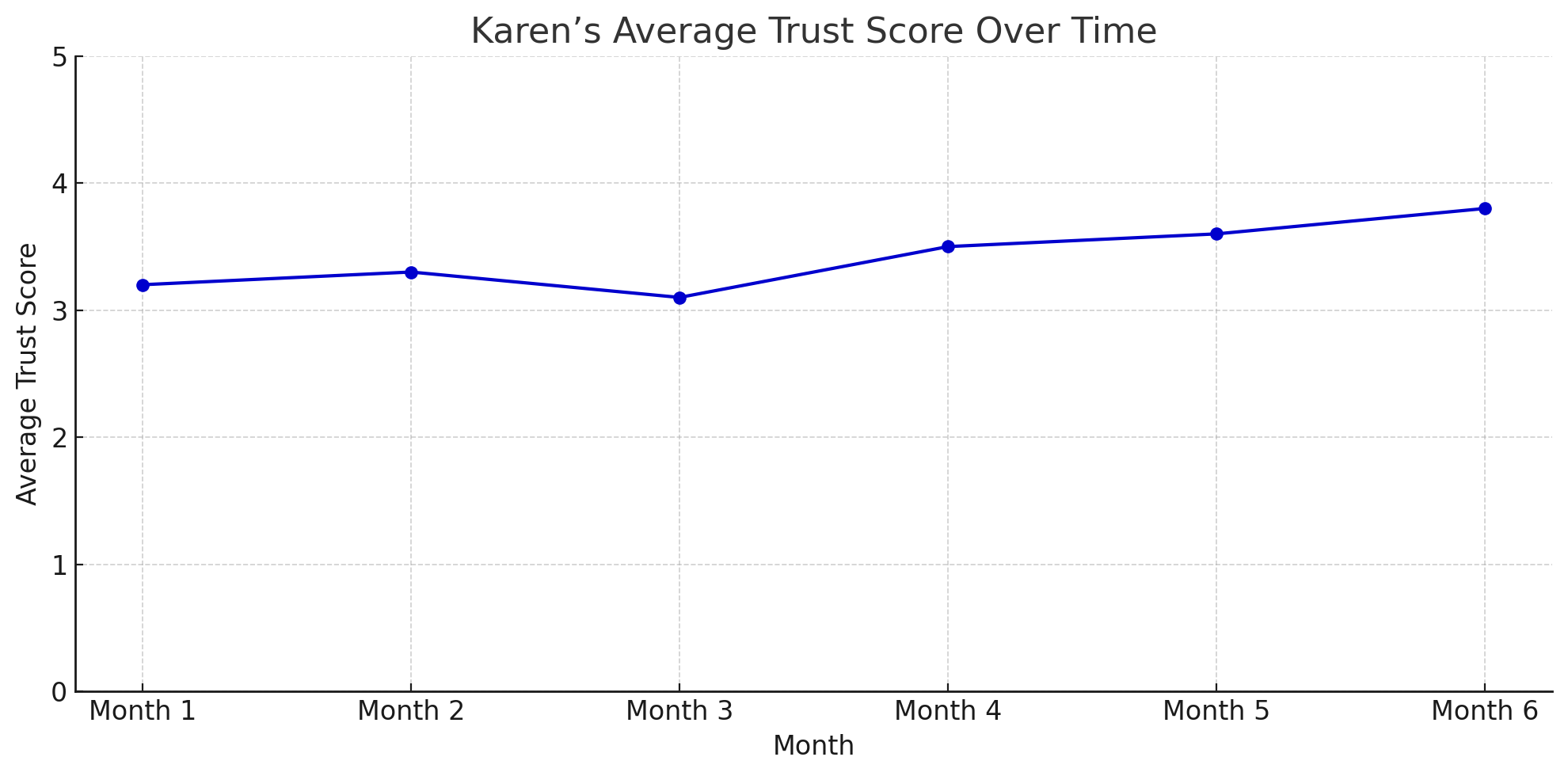

Karen’s Average Trust Score Over Time

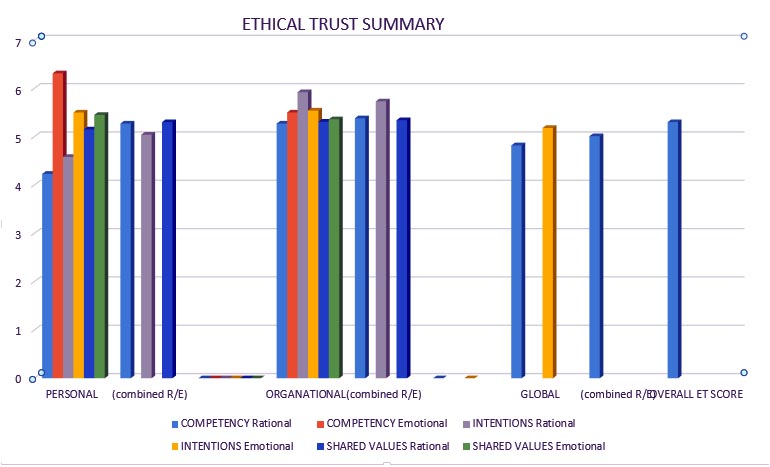

Here is the trust profile of Karen as seen through the eyes of her clients—Bill, Tasha, and Mike. The data table shows how each client rates her across the six trust characteristics, with a split between Rational and Emotional trust.

Additionally, the chart tracks Karen’s average trust score over six months, showing a clear upward trend—a sign that her relationships with clients are steadily strengthening.

ChatGPT said:

Karen’s Overall Trust Profile Summary

-

Overall Average Trust Score: 2.75

-

Highest Rated Trust Characteristic: Integrity

-

Lowest Rated Trust Characteristic: Communications

-

Average Rational Trust Score: 2.89

-

Average Emotional Trust Score: 2.61

Key Insight

Karen is seen as ethical and trustworthy, with solid technical credibility. But her communication style is holding her back, especially on the emotional side. Clients need her to connect more personally, not just provide information.

ChatGPT said:

Full Trust Profile: Karen – Financial Advisor

Based on client trust ratings from Bill, Tasha, and Mike across all six characteristics of the Optimal Trust Framework

Overall Trust Snapshot

-

Overall Average Trust Score: 2.75 / 5

-

Rational Trust Score: 2.89

-

Emotional Trust Score: 2.61

-

Highest Rated Trust Characteristic: Integrity

-

Lowest Rated Trust Characteristic: Communications

Karen’s Strengths

✅ 1. Integrity (Highest Rated)

Clients see Karen as honest, ethical, and trustworthy.

-

Bill respects her straightforward approach, even if emotionally reserved.

-

Tasha feels Karen is transparent and has her best interests at heart.

-

Mike trusts that Karen isn’t trying to push a sale—she acts ethically.

🟢 This is the backbone of Karen’s relationships—clients feel she’s not “selling” them something, but genuinely working in their interest.

✅ 2. Competency

All three clients rate Karen’s knowledge and expertise highly.

-

She explains financial options clearly, though sometimes with too much detail.

-

Clients believe she can be counted on for accurate and practical guidance.

🟢 She is technically strong—her challenge is translating that strength into trust-building, emotionally supportive conversations.

Areas for Growth

🚩 1. Communications (Lowest Rated)

Karen tends to over-explain or lead with information rather than empathy.

-

Bill feels overwhelmed and disengaged when discussions get too technical.

-

Tasha struggles with jargon and feels lost at times.

-

Mike notices the focus is often on financial logic rather than his emotional needs.

🔧 Recommendation:

-

Lead with questions, not answers. Ask how the client is feeling before presenting data.

-

Use plain language: say “growing your savings safely” instead of “diversifying assets.”

-

Build in pauses: “Let’s take a step back—what part of this feels unclear or stressful?”

⚠️ 2. Emotional Resonance

Karen’s emotional trust score lags behind her rational score.

-

She builds confidence with facts but misses chances to show empathy or personal understanding.

🔧 Recommendation:

-

Mirror client concerns. When someone says, “This feels overwhelming,” don’t respond with a chart—say, “That makes sense. A lot of people feel that way.”

-

Share human moments. Clients trust more when they feel seen.

🎯 Final Summary

Karen is a technically capable, ethical, and sincere advisor who has built a foundation of trust through her consistency and integrity. To reach the next level with her clients, she must shift from being just a “knowledge provider” to becoming a true emotional partner—someone who meets clients where they are, with empathy, curiosity, and language they understand.

© Copyright OPTIMAL TRUST