TrustQ: OPTIMAL TRUST GRID

Harvard University vs. Trump Administration

An Optimal Trust Analysis:

1. Harvard University vs Trump Administration

2. What this means as for you as a Financial Advisor

3. What it means for your clients

4. The Impact on 3 Key Business Sector

5. The Impact on 3 Stock Markets (NASDAQ, CSI300, DJ Transportation)

TRUSTQ Newsfeed (May 4, 2025): What happens when the Trump Administration clashes with Harvard University

On May 2, 2025, President Donald Trump announced plans to revoke Harvard University's tax-exempt status, citing alleged political and ideological bias. Harvard responded, asserting that such action lacks legal basis and would jeopardize its educational mission. This confrontation is part of a broader campaign by the Trump administration targeting elite universities over issues like campus protests and diversity policies. Reuters+1The Daily Beast+1WSJ

Optimal Trust Analysis:

Harvard University vs Trump Administration

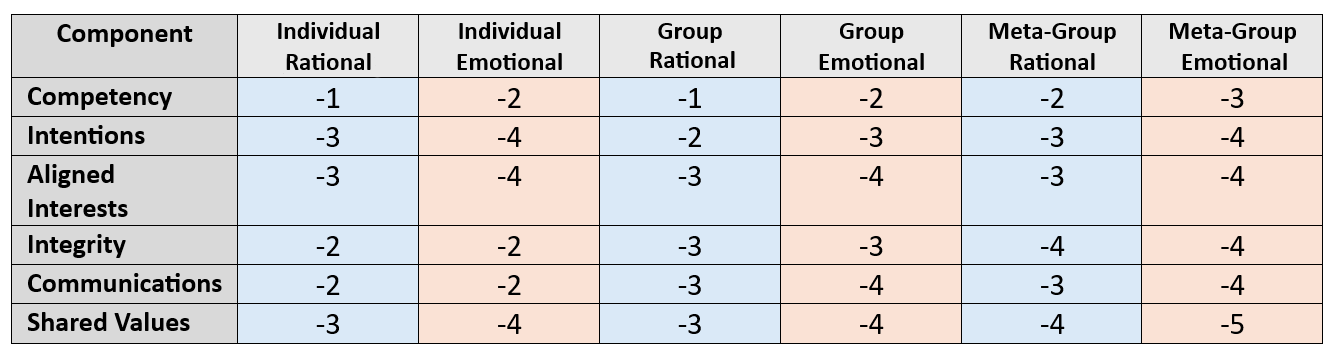

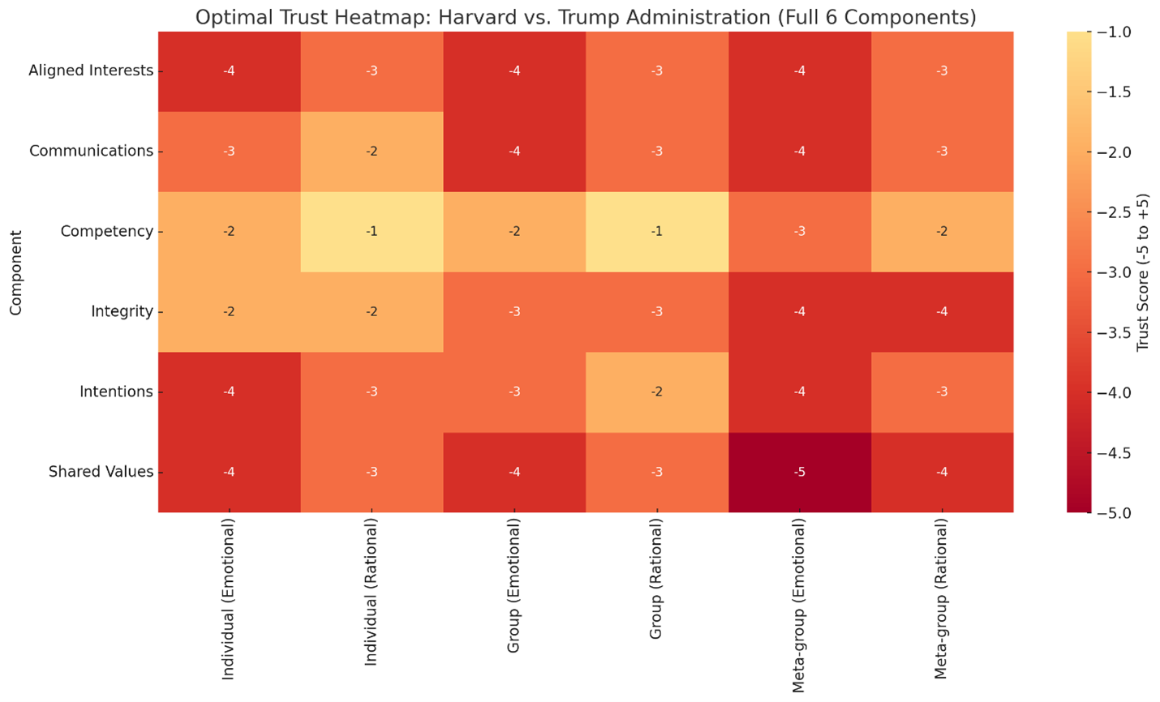

Optimal Trust Grid (Full Six Components)

🧭 Narrative Summary: The Trust Breakdown

🧭 Narrative Summary: The Trust Breakdown

The clash between Harvard University and President Trump is not just a legal or political dispute—it is a systemic collapse in mutual trust. What we’re witnessing is:

- A personalized power move by the President,

- A principled institutional defense by Harvard,

- And a growing public anxiety about what happens when politics and education collide at this scale.

Even though both parties are operating within legal frameworks, the emotional trust—the sense that intentions are fair, values are shared, and communication is in good faith—has eroded dramatically.

🔍 Breakdown by Trust Component

- 🧠 Competency

- Individual (Rational: -1 / Emotional: -2)

Trump’s declarations via social media seem uninformed about IRS process. Harvard shows legal clarity, but its response risks sounding insular. - Group (Rational: -1 / Emotional: -2)

The administration appears disorganized (no IRS follow-through), while the Harvard community fears their leaders are reacting, not proactively protecting values. - Meta-group (Rational: -2 / Emotional: -3)

The public perceives systemic dysfunction: is higher education governed by policy or politics?

- 🎯 Intentions

- Individual (Rational: -3 / Emotional: -4)

Trump’s “It’s what they deserve” framing suggests vengeance. Harvard’s response appeals to mission, but is defensive. - Group (Rational: -2 / Emotional: -3)

University and government appear locked in a zero-sum moral war. Faculty and students feel targeted; federal actors claim they’re protecting fairness. - Meta-group (Rational: -3 / Emotional: -4)

Elite institutions and government no longer appear to be playing by shared rules of respect or neutrality.

- ⚖️ Aligned Interests

- Individual (Rational: -3 / Emotional: -4)

Each actor seems to believe they represent “the public interest”—but they’re pursuing mutually exclusive visions of it. - Group (Rational: -3 / Emotional: -4)

The Harvard community and federal agencies do not see their futures as connected. - Meta-group (Rational: -3 / Emotional: -4)

The fracture suggests higher education and national governance are no longer rowing in the same direction.

- 🧾 Integrity

- Individual (Rational: -2 / Emotional: -2)

Trump’s personal attacks contradict legal norms. Harvard’s response is measured, but lacks public emotion. - Group (Rational: -3 / Emotional: -3)

Integrity here is contested: who’s upholding values? Each side claims moral high ground. - Meta-group (Rational: -4 / Emotional: -4)

Broader trust in both government and elite institutions suffers. People wonder: who’s playing fair?

- 📡 Communications

- Individual (Rational: -2 / Emotional: -3)

Harvard uses legalistic press releases; Trump posts declarative threats. The modes couldn’t be more mismatched. - Group (Rational: -3 / Emotional: -4)

Dialogue has broken down entirely. Statements are made about each other, not to each other. - Meta-group (Rational: -3 / Emotional: -4)

Public discourse suffers. The nation gets performative conflict, not substance or negotiation.

- 🤝 Shared Values

- Individual (Rational: -3 / Emotional: -4)

There is no visible overlap in what either party believes higher education should be. - Group (Rational: -3 / Emotional: -4)

Communities on both sides feel their very identity is under attack. Culture war logic dominates. - Meta-group (Rational: -4 / Emotional: -5)

At the societal level, this conflict feels existential: meritocracy vs. populism, freedom vs. control, truth vs. loyalty.

🔥 Trust Collapse Zones (Most Damaged)

- Trust Component Worst Zones:

- Shared Values - Meta-group (Emotional) -5

- Intentions - Individual & Meta-group (Emotional) -4

- Communications - Group & Meta-group (Emotional) -4

- Aligned Interests - All levels (Emotional) -4

🛠️ Trust Repair Recommendations

For Harvard:

- Broaden the Narrative

Frame its defense not as elite self-preservation, but a stand for all nonprofits: small colleges, local arts orgs, libraries. - Empathic Messaging

Speak not just of legal harm, but of national values. Show how defunding Harvard also harms veterans’ research, rural education partnerships, and medical breakthroughs. - Coalition Leadership

Lead a unified, cross-ideological group of universities, nonprofits, and religious institutions to protect the principle of tax-exempt autonomy.

For the Federal Administration:

- Clarify Process & Boundaries

Publicly affirm the IRS’s independence and explain the boundaries between political speech and administrative action. - Refocus on Policy, Not Personality

If reform is the goal, draft clear policy proposals. Targeting specific institutions signals vendetta, not vision. - Signal National Unity

Propose a convening or commission on the future of nonprofit accountability—frame it as a reform conversation, not a reckoning.

🧠 Final Thought

This isn’t just Harvard vs. Trump. It’s America wrestling with its own values:

- Is education an independent good or a tool of ideology?

- Can governance respect institutional autonomy without losing authority?

Trust can only begin to rebuild when both sides stop fighting each other’s symbols—and start speaking to the real substance of what they fear, and what they stand for.

Why is this confrontation important to Financial Advisors?

Let’s reframe the Harvard–Trump tax-exemption conflict through the lens of financial advisors and their clients. This isn’t just a culture war headline. It’s a trust signal—a red flag in the broader landscape that affects how investors perceive nonprofits, policy risk, institutional stability, and philanthropic strategy.

Here’s why it matters:

🧭 Why This Debate Matters to Financial Advisors and Clients

- 🧨 Precedent Risk: Institutional Vulnerability

If Harvard can be targeted, what about hospitals, foundations, or religious charities?

For HNW clients who give to, work with, or sit on boards of nonprofits, this is a wake-up call. The sanctity of 501(c)(3) status—once a third rail—is now politically exposed. Advisors need to be fluent in nonprofit governance risk and how to future-proof client strategies.

- 📉 Market Signals: Volatility of Policy

Sudden policy threats—even without legal teeth—rattle institutional confidence.

This isn’t just about Harvard. It’s about how quickly tax policy can become political—and how markets respond to uncertainty. Financial advisors must be alert to policy-induced volatility, especially in sectors tied to philanthropy, education, and healthcare.

- 💸 Philanthropic Planning: Donation Hesitation

If tax deductibility is under fire, giving patterns may shift.

Many clients contribute significantly to endowments and nonprofits. If tax benefits appear vulnerable, advisors may see a shift toward donor-advised funds, private foundations, or alternative giving vehicles that feel more secure or flexible.

- 🧠 Trust Signals: What Institutions Represent

Clients look at the landscape not just for returns—but for values.

Some clients are asking, “Are elite institutions out of touch?” Others are asking, “Is government overreaching?” These aren’t just political questions—they’re trust questions. And trust influences everything from brand loyalty to real estate preferences to investment ethics.

- 🤝 Advisor's Role: Interpreter of Uncertainty

Your value is in helping clients see not just what’s happening, but what it means.

When news feels tribal and chaotic, the advisor’s job is to restore context and clarity. Harvard vs. Trump isn’t just Harvard vs. Trump. It’s a signal of changing norms—around power, taxes, giving, and institutional independence.

🛠️ How Advisors Can Talk About It With Clients

- “This story about Harvard might seem niche, but it’s actually a signal of broader policy volatility. Here’s how we’re accounting for that in your plan.”

- “Your philanthropic giving is important to you. Let’s make sure it’s also resilient if tax incentives shift or nonprofits become more politically exposed.”

- “These moments test our trust—in institutions, in government, in long-term strategy. My job is to help you stay grounded, informed, and prepared.”

Why is it important to your Clients?

Here’s a client-facing briefing sheet for financial advisors to share during meetings, emails, or presentations. It’s designed to help clients understand why the Harvard–Trump tax debate matters to them, and how their advisor is watching the bigger picture.

📣 Client Briefing: What the Harvard–Trump Tax Debate Means for You

Understanding the headlines, protecting your plan.

What’s Happening?

President Trump recently threatened to revoke Harvard University’s tax-exempt status, claiming the school no longer deserves its nonprofit privileges. Harvard responded forcefully, stating such a move would be illegal and devastating to its mission. It’s unclear whether the IRS is acting on this—but the message is clear: even elite institutions are now targets of political and policy volatility.

🔍 Why This Matters to You

🧨 Nonprofit Risk Is Now Political

- If Harvard is vulnerable, so are hospitals, research institutes, and cultural organizations.

- Clients involved in philanthropy or nonprofit boards should prepare for potential shifts in regulation and scrutiny.

📉 Policy Moves Can Rattle Markets

- This isn’t just about Harvard—it signals broader unpredictability in how tax rules and institutional protections are applied.

- Uncertainty like this can shake confidence in sectors tied to education, healthcare, and public services.

💸 Your Giving Strategy May Need an Update

- Tax deductibility is a key driver of charitable giving. If political forces begin targeting that status, alternative structures (like donor-advised funds or private foundations) may become more appealing.

🧠 It’s About More Than Politics—It’s About Trust

- These events reflect deeper shifts in how people perceive institutions, authority, and fairness.

- Trust, once lost, impacts everything: markets, consumer behavior, and long-term financial security.

🧭 What We're Watching For You

- We monitor regulatory and policy shifts that may affect your investments and giving strategies.

- We help ensure your estate and philanthropic plans remain tax-efficient and future-proof.

- We offer perspective—not just on the news, but on what it means for your life, goals, and legacy.

Bottom Line:

These moments show why having a steady, strategic financial plan matters more than ever. You don’t need to react to every headline—but you deserve to know how they affect your financial future.

Let’s talk if you’d like to review your plan.

—

[Your Name]

[Your Firm Name]

[Contact Info]

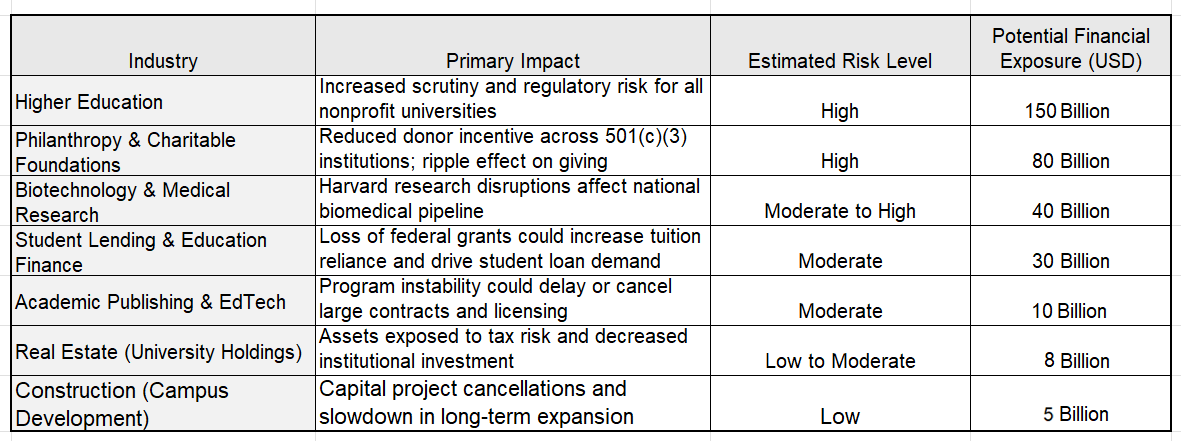

Potential Impact on Various Industries if Harvard's Tax Exempt Status is Revoked

Here’s a detailed breakdown of industries that could be affected if Harvard’s tax-exempt status is revoked, along with estimated financial exposure and risk levels. The ripple effect would stretch far beyond academia—touching philanthropy, medical research, publishing, construction, and real estate markets.

Client Briefing: What If Harvard Loses Its Tax-Exempt Status?

Understanding the broader market ripple effects

Context

President Trump’s renewed threats to revoke Harvard University’s tax-exempt status—once unthinkable—are sending shockwaves through higher education and the broader nonprofit economy. While the legal outcome remains uncertain, the trust breakdown between government and academia is real, and the economic stakes are high.

Why It Matters to You

A. As an Investor

-

Institutions once seen as “risk-free anchors” may now face regulatory or financial threats.

-

Tax-sensitive giving and research flows influence sectors from real estate to biotech.

B. As a Donor or Client With Philanthropic Interests

-

Trust-based giving is at risk. You may want to revisit the vehicles (DAFs, trusts, foundations) that protect your intent over time.

C. As a Participant in the Innovation Economy

-

If Harvard and peer institutions slow down, entire R&D and hiring pipelines shrink.

-

Long-term value creation in fields like climate tech, life sciences, and AI may stall.

What We’re Watching For You

-

IRS or Congressional actions against other major universities or research hubs

-

Changes to 501(c)(3) policy language and enforcement practices

-

Shifts in university endowment strategy or asset reallocation

-

Market signals from private capital (e.g., movement of philanthropic funds overseas or to donor-advised funds)

Bottom Line:

This isn’t just a Harvard issue. It’s a stress test for how America values its intellectual infrastructure. As your advisor, I’m here to help you navigate shifting policy landscapes, safeguard your assets and legacy, and invest with confidence—even in moments of institutional uncertainty.

—

[Your Name]

[Your Firm Name]

[Contact Info]

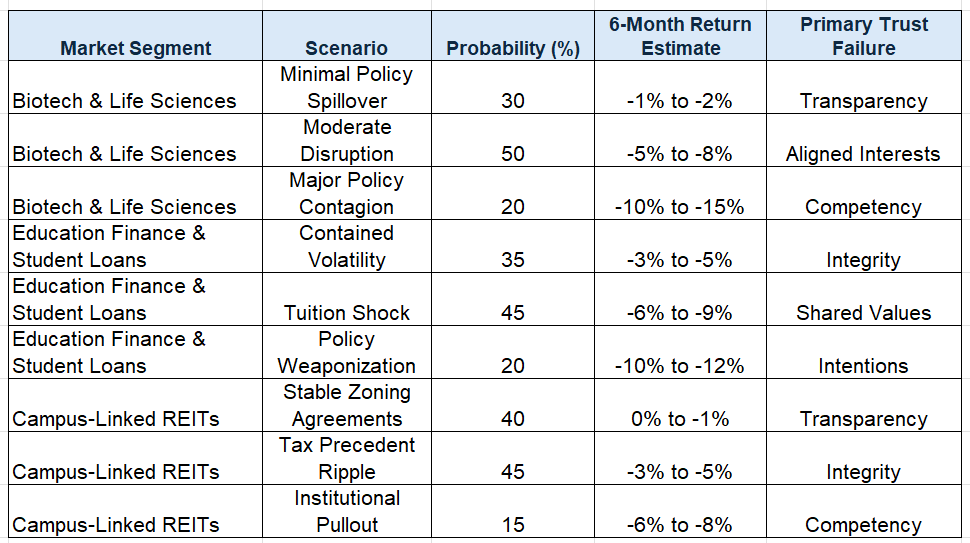

Top 3 Stock Market Segments Likely to Be Affected

- Biotech & Life Sciences Indexes (e.g., NASDAQ Biotechnology Index)

🔻 Predicted Direction: Moderate Decline (Short-to-Mid Term)

Why it matters:

- Harvard-affiliated labs and hospitals (e.g., Dana-Farber, Broad Institute) are cornerstone partners in early-stage R&D.

- Loss of trust in academic institutions = slowdown in grants, trials, and research pipelines.

- Venture capital funding often tracks university research credibility.

Expected Market Impact:

- -5% to -8% drag in biotech indexes

- Midcap R&D-heavy firms more vulnerable than large pharma

Trust Component Breakdown:

- Competency: Reduced output and collaboration

- Aligned Interests: Pharma–academic partnership tensions

- Transparency: Fear of policy unpredictability

- Education-Linked Finance (e.g., SOFI, Sallie Mae, Student Loan REITs)

🔻 Predicted Direction: Volatile and Policy-Sensitive

Why it matters:

- If elite universities lose tax breaks, tuition may rise and federal support shrink.

- Student lending becomes a more contested—and riskier—space.

- Risk of regulatory backlash or increased default probability.

Expected Market Impact:

- -5% to -10% volatility range, especially for private lenders

- Possible tightening of credit access or rising borrowing costs

Trust Component Breakdown:

- Integrity: Erosion of perception of fairness in higher education

- Intentions: Political motives perceived as punitive

- Shared Values: Debate over meritocracy vs. ideology

- U.S. REITs with University-Linked Assets (e.g., American Campus Communities)

🔻 Predicted Direction: Mild but Lasting Impact

Why it matters:

- Real estate owned by or leased to nonprofits may now be taxable.

- Harvard has vast property assets, and precedent may ripple across cities with major academic real estate zones.

- Municipalities may re-evaluate zoning and PILOT agreements.

Expected Market Impact:

- -3% to -5% dip in university-adjacent REITs or education infrastructure ETFs

- New capital projects may be postponed, tightening contractor cash flow

Trust Component Breakdown:

- Transparency: Sudden policy changes reduce predictability

- Integrity: Market questions what’s sacred and what’s politically expedient

- Competency: Tax law enforcement viewed as erratic

🧭 Summary Table

Market Segment

Biotech & Life Sciences

Education Finances & Student Loans

Real Estate (Campus-Linked REITs)

Expected Impact

-5% to -8%

-5% to -10% (volatile)

-3% to -5%

Key Trust Breakdown

Competency, Aligned Interests, Transparency

Integrity, Intentions, Shared Values

Transparency, Integrity, Competency

Probability-Weighted Stock Market Forecast - Harvard Tax Policy

Here is a probability-weighted, 6-month forecast model for how three major stock market sectors could respond if Harvard’s tax-exempt status is revoked. Each scenario includes:

- Likely return range

- Associated probability

- Key trust components in breakdown

This model can help guide investment conversations, sector reallocation strategies, and client reassurance in a policy-sensitive market environment.

© Copyright OPTIMAL TRUST