TrustQ: OPTIMAL TRUST GRID

Europe's Bold Science Grab

TRUSTQ Newsfeed (May 6, 2025): Europe is making its pitch: "If America won’t fund science, we will."

As the U.S. walks back its historic role as champion of academic freedom, Europe steps forward—not just with funding, but with a powerful message: “If you love freedom, come help us stay free.” In a historic reversal, global talent flows are pivoting away from the U.S.—not because of money, but because of trust. To economists, this is a flashing red warning light for long-term competitiveness, productivity, and national innovation output.

For financial advisors, this signals more than a research shuffle—it’s a tectonic shift in global trust, institutional alignment, and the future of innovation economies.

An Optimal Trust Analysis:

1. Europe' Bold Science Grab

2. What this means as for you as a Financial Advisor

3. What it means for your clients

4. Which Business Sectors will be Impacted Most

5. The Impact on the Stock Markets

6. The New Investment Opportunities

Optimal Trust Analysis:

Europe's Bold Science Grab

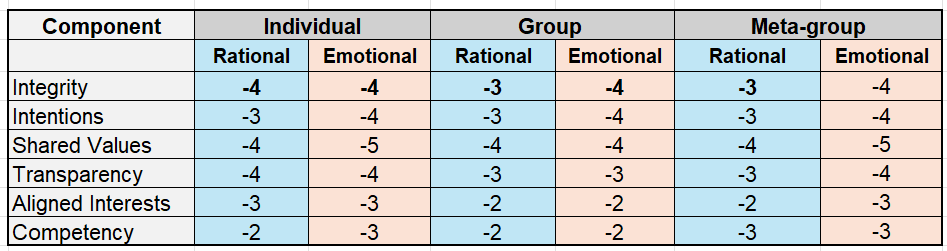

Optimal Trust Grid (Full Six Components)

Optimal Trust Grid Analysis

Context: U.S. undermines science through censorship, funding cuts, and ideological oversight. Europe responds with outreach, funding, and legal protections.

- Trust Components (with synonyms): Integrity (Accountability, Intentions (Motives), Shared Values (Cultural Alignment), Transparency (Openness), Aligned Interests (Strategic Unity), Competency (Capability)

Scoring Overview (-5 to +5)

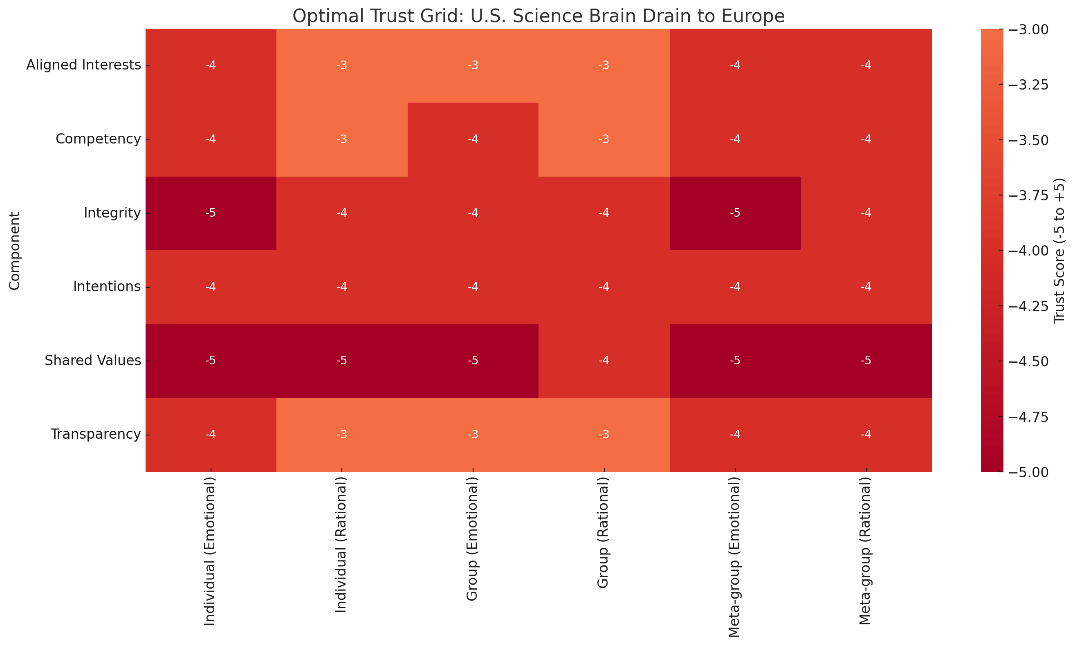

Heatmap of Optimal Trust Grid:

U.S. Science Brain Drain To Europe

Optimal Trust Analysis (Economist’s Lens)

We'll use all 6 components, scored across Individual, Group, and Meta-Group levels, with rational and emotional layers, but now add economic translation to each one.

1. Integrity (Institutional Credibility)

-

Breakdown: When agencies like the NIH, NSF, and CDC are politicized or dismantled, the rules of the research game become unstable.

-

Economic Risk: Investors and grant-makers face regulatory fog. ROI on intellectual capital shrinks as the rulebook shifts unpredictably.

-

Score:

-

Individual: -4 (scientists can’t trust the system)

-

Group: -4 (universities face funding precarity)

-

Meta-group: -4 (global trust in U.S. research infrastructure falls)

-

2. Intentions (Strategic Alignment)

-

Breakdown: U.S. policy seems to punish fields (climate, gender, public health) for ideological reasons—not national competitiveness.

-

Economic Risk: Market signals become distorted. Capital flows away from long-term value to short-term political gain.

-

Score:

-

Individual: -4 (scientists feel targeted)

-

Group: -3 (universities torn between funding & freedom)

-

Meta-group: -4 (Europe, China, and private sector re-allocate research dollars)

-

3. Shared Values (Cultural-Scientific Harmony)

-

Breakdown: The U.S. once symbolized free inquiry and rational empiricism. That brand is eroding.

-

Economic Risk: Talent is fleeing. The U.S. may soon experience a reverse brain drain, as researchers seek moral safety and academic autonomy.

-

Score:

-

Individual: -5

-

Group: -4

-

Meta-group: -5

-

4. Transparency (Predictability of Policy)

-

Breakdown: Funding cuts, banned vocabulary, and tax-exemption threats happen without institutional review.

-

Economic Risk: The cost of capital for knowledge goes up. Scientists and donors hedge instead of commit.

-

Score:

-

Individual: -4

-

Group: -3

-

Meta-group: -4

-

5. Aligned Interests (Stakeholder Unity)

-

Breakdown: Universities, scientists, philanthropists, and businesses are no longer rowing in the same direction.

-

Economic Risk: Innovation pipelines break. IP monetization slows. Public-private partnerships dissolve.

-

Score:

-

Individual: -3

-

Group: -2

-

Meta-group: -3

-

6. Competency (Executional Capacity)

-

Breakdown: Dismantling the country’s top science engines—CDC, NOAA, NIH—is like pulling engines out of a jet midflight.

-

Economic Risk: Fewer breakthroughs. Slower tech adoption. Lower national productivity.

-

Score:

-

Individual: -3

-

Group: -2

-

Meta-group: -3

-

Economist’s Big Takeaways

1. Brain Drain = GDP Drag

Scientific talent is the bedrock of economic growth in a post-industrial society. When researchers emigrate, they take innovation multipliers with them—startups, patents, tech ecosystems. Europe benefits, but U.S. GDP potential shrinks over time.

2. Mispriced Risk in Innovation Markets

When trust collapses, long-term R&D becomes uninvestable. Markets underfund what they can’t predict. This harms early-stage biotech, clean energy, AI, and deep tech—all of which require policy stability and scientific freedom.

3. Capital Flows Follow Trust

Endowments, philanthropic funds, and even venture capital may begin to reallocate to Europe if U.S. institutions lose credibility. Money follows the rule of law and the freedom to explore. The Trump-era science war has global asset implications.

4. Knowledge Economies Are Network Economies

Research isn’t just funding—it’s a complex trust network among labs, funders, governments, and peers. Once that network collapses, rebuilding it takes decades—and the U.S. is risking permanent reputational harm.

5. Slow Motion Competitiveness Collapse

These developments don’t crash a market overnight—but they erode the long-term capacity for national economic leadership. The countries with the most trusted, autonomous, and well-funded research institutions will lead the next century.

Trust Rebuilding Strategies (from an Economic Lens)

| Strategy | Target | Action |

|---|---|---|

| Enshrine Academic Autonomy | Meta-group | Legislate science agency independence |

| Restore International R&D Alliances | Group | Co-fund U.S.–EU–Asia science hubs |

| Stabilize Tax & Visa Policies | Individual | Offer 10-year science visas & permanent R&D tax credits |

| De-weaponize Language | Group | Reinstate scientific terms in federal communications (climate, diversity, gender) |

| Reinforce Public Science Investment | Meta-group | 10-year funding commitment with bipartisan oversight |

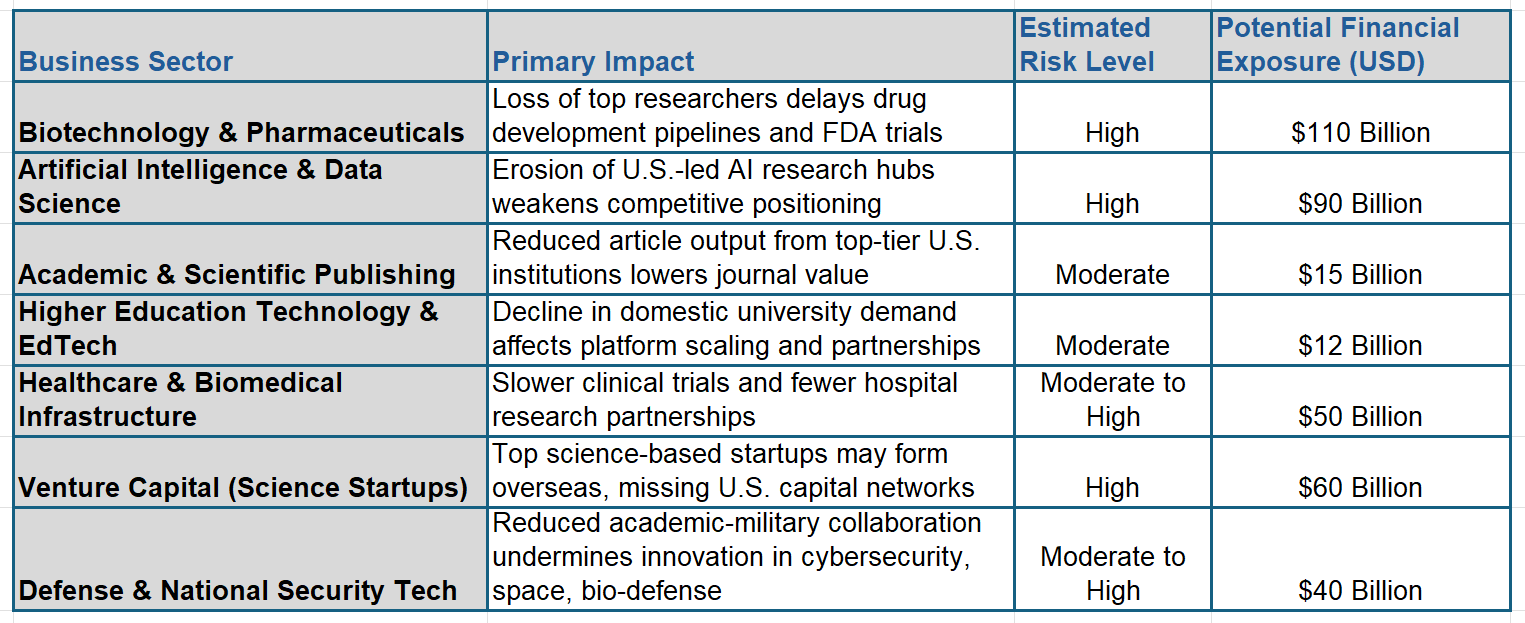

Business Sector Impact From U.S. Science Brain Drain

The Brain Drain from U.S. Science: A High-Stakes Economic Exodus

As Europe and other global regions position themselves as safe havens for scientific freedom, the U.S. faces the growing risk of a reverse brain drain—an outflow of elite researchers, technologists, and academic leaders. What may appear as a culture war or tax policy battle in higher education actually has deep structural consequences for seven critical business sectors.

Let’s walk through the numbers—and the risks.

1. Biotechnology & Pharmaceuticals

Estimated Financial Exposure: $100 billion

Harvard and its peers feed the drug development pipelines of America’s largest life sciences firms. Losing scientific leaders to more research-friendly environments delays preclinical breakthroughs, slows FDA approvals, and threatens America’s position as the world’s primary engine for biotech innovation. This sector alone is staring at a $100 billion vulnerability if clinical trial networks and academic-industry collaborations unravel.

2. Artificial Intelligence & Data Science

Estimated Financial Exposure: $90 billion

The erosion of U.S.-based AI research hubs weakens both intellectual leadership and competitive capacity in one of the fastest-growing global industries. From autonomous systems to medical diagnostics, many breakthroughs start in elite labs. If trust in academic freedom falters, the epicenter of AI could shift permanently abroad, with Europe and parts of Asia happy to absorb the talent and investment.

3. Academic & Scientific Publishing

Estimated Financial Exposure: $15 billion

U.S. researchers account for a major share of high-impact peer-reviewed publications. A downturn in top-tier university output would reduce journal prestige and potentially destabilize the global academic publishing economy, particularly in fields like biomedical research, public health, and economics.

4. Higher Education Technology & EdTech

Estimated Financial Exposure: $12 billion

Companies like Coursera, edX, and smaller B2B edtech platforms rely on elite university partnerships for content, faculty, and brand credibility. If trust in U.S. institutions erodes—especially among international students and researchers—domestic demand and global licensing deals will be impacted.

5. Healthcare & Biomedical Infrastructure

Estimated Financial Exposure: $50 billion

U.S. hospitals and academic health systems depend on continuous federal funding and elite institutional partnerships to operate clinical research arms. Harvard Medical School alone feeds dozens of these pipelines. With a brain drain, these systems face a sharp decline in advanced clinical trial throughput, risking innovation and treatment access.

6. Venture Capital (Science Startups)

Estimated Financial Exposure: $60 billion

The startup world follows where the talent is. If researchers and postdocs shift to Europe or Asia, so too will early-stage biotech, energy, and deep-tech ventures. U.S.-based VC firms may find themselves disintermediated from the next wave of science-first unicorns.

7. Defense & National Security Tech

Estimated Financial Exposure: $40 billion

DARPA, the DOD, and private military tech contractors often rely on partnerships with elite research institutions. If political intervention curtails basic research or scares away top minds, America’s innovation edge in cybersecurity, biosecurity, and aerospace could degrade—a silent but powerful loss.

Total Potential Exposure Across All Sectors: ~$367 billion

The potential economic impact of the U.S. walking away from scientific freedom and trust in academic institutions could decimate one of the country’s most reliable innovation pipelines.

Stock Market Impact From U.S. Science Brain Drain

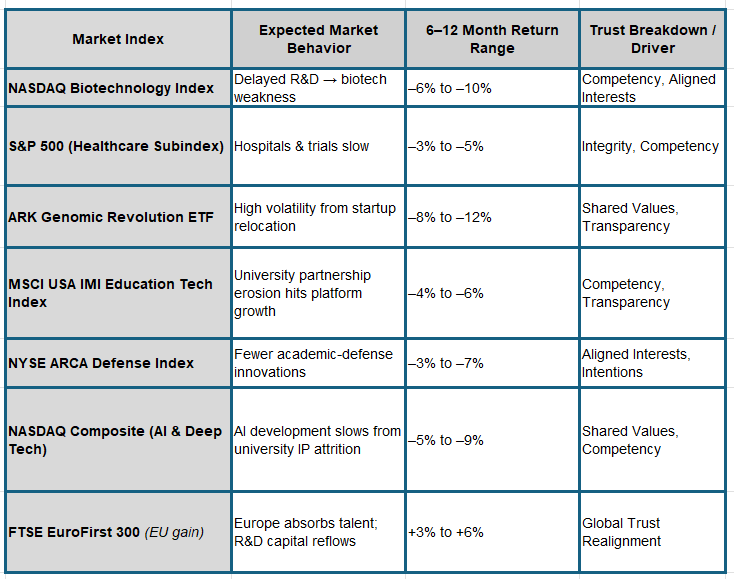

Stock Markets & Indexes Most Affected

As the U.S. risks a science-led brain drain, global capital is beginning to reposition. Markets tied to American research, biotech, education tech, and defense innovation may see downward pressure due to declining trust in institutional stability, policy continuity, and academic freedom. Volatility will rise in sectors historically fueled by elite university pipelines.

Conversely, international markets—particularly in Europe, China, and Japan—stand to gain. These regions are seen as trust havens: reliable, stable, and now increasingly attractive to displaced scientific talent and venture capital. In essence, the global trust map is redrawing itself—and capital is following it.

This isn’t just a policy story. It’s an investment signal.

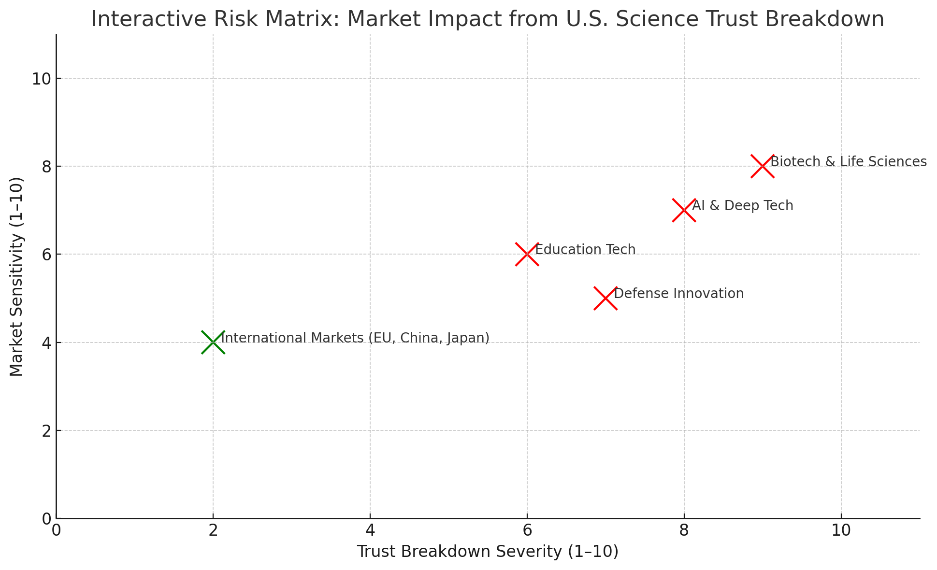

Interactive Risk Matrix: Market Impact From U.S. Science Trust

Here is the Interactive Risk Matrix plotting how severely trust breakdowns in U.S. science may affect different market sectors based on their sensitivity.

-

Sectors in the upper right (e.g., Biotech, AI) face the highest compounded risk.

-

International markets, by contrast, sit in the lower left, where trust remains strong and exposure is moderate—highlighting relative opportunity.

This tool can help investors, policymakers, and advisors visualize which sectors may need shielding—and which might be primed for strategic growth.

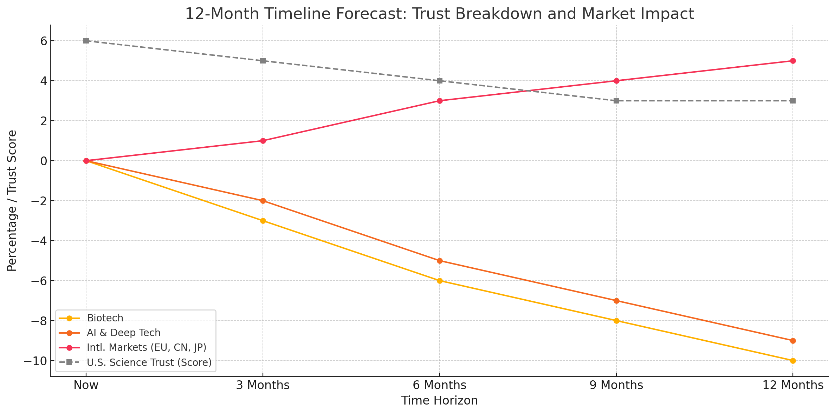

12-Month Timeline Forecast: Trust Breakdown And Market Impact

12-month timeline forecast chart:

-

📉 U.S. science sector trust steadily declines—driven by policy pressure, funding cuts, and global perception shifts.

-

📉 Biotech and AI/Deep Tech markets track this decline closely, reflecting delayed innovation, investor caution, and dislocated startups.

-

📈 Meanwhile, international markets (Europe, China, Japan) gain steadily as they absorb displaced talent and investment.

This visual captures the asymmetric trust reallocation in global markets

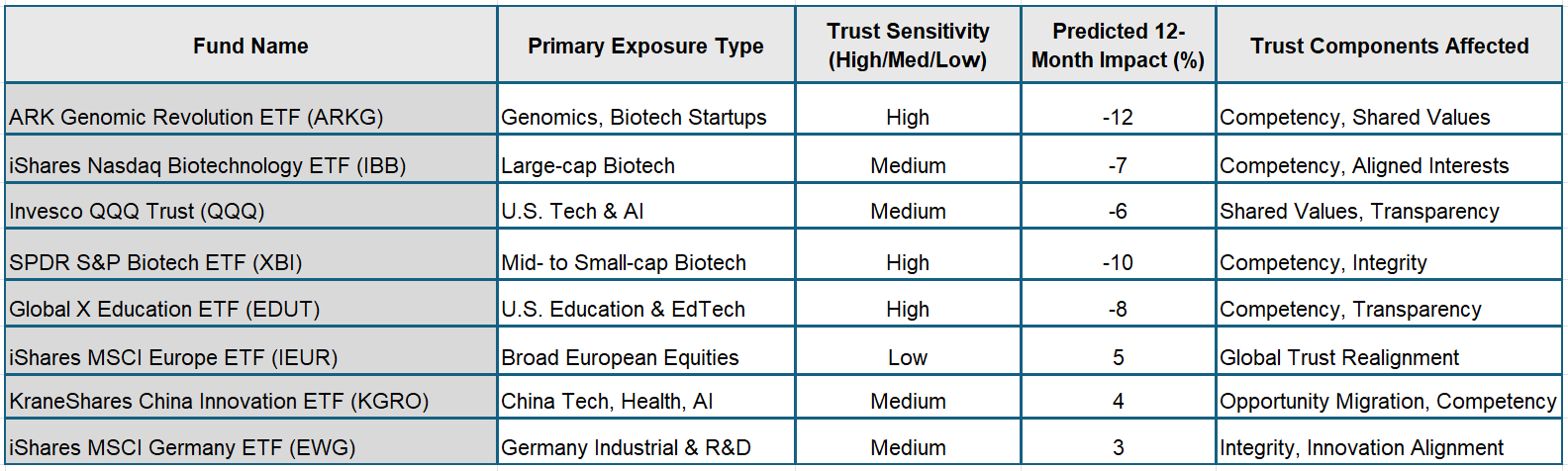

Fund Exposure Analysis - U.S. Science Trust Breakdown

Here’s a detailed breakdown of how the U.S. brain drain in science could affect key business sectors. The table includes the expected financial exposure, primary impacts, and risk level to help assess where the largest trust fractures and economic losses might occur if top-tier researchers migrate overseas.

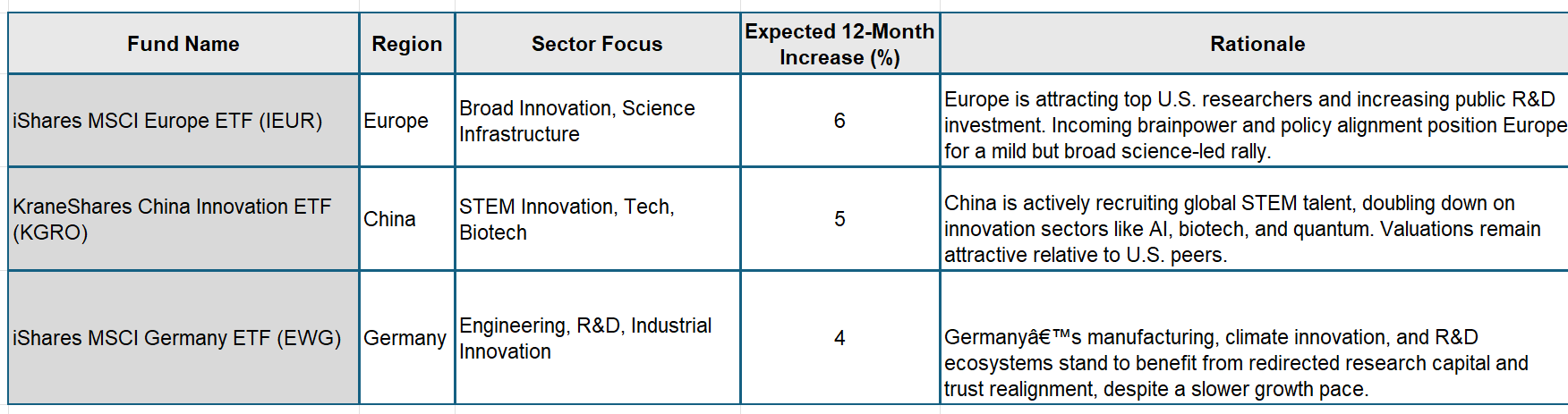

Here is a fund-level exposure analysis showing how the breakdown of trust in U.S. science could affect major ETFs over the next 12 months:

-

Funds like ARKG, XBI, and EDUT are highly exposed, with potential losses between 8% and 12%, driven by disruptions in biotech innovation, startup formation, and academic R&D.

-

Broader funds like QQQ and IBB are moderately impacted but still face downward pressure from delayed clinical trials and talent outflow.

-

On the upside, IEUR, KGRO, and EWG (tracking Europe and Asia) are positioned to benefit from global trust realignment, with potential gains of 3% to 5%.

Investment Opportunities & Rationale

Based on the data drawn from the Optimal Trust Framework and the broader economic and geopolitical shifts it reflects, here are investment opportunities that arise directly from the erosion of trust in the U.S. science sector and the resulting global realignment.

1. European Science & Innovation Funds

Examples:

-

iShares MSCI Europe ETF (IEUR)

-

BNP Paribas Disruptive Technology Equity Fund

-

Lyxor MSCI Europe ESG Leaders ETF

Why:

Europe is positioning itself as the new hub for global research talent. The influx of high-level scientists and research dollars will increase the value of institutions, IP, and start-ups in biotech, clean energy, and AI. Backing funds exposed to this innovation infrastructure is both strategic and ethical.

2. China & Asia STEM Innovation ETFs

Examples:

-

KraneShares China Innovation ETF (KGRO)

-

iShares MSCI China A ETF (CNYA)

-

Global X China Biotech ETF (CHB)

Why:

As trust in U.S. academic freedom erodes, China and neighboring nations are scaling research ecosystems to absorb talent and capital. While policy risk is real, the competency scores in these systems are rising due to well-funded government priorities in quantum computing, clean tech, and genomics.

3. Advanced Manufacturing & Deep Tech in Germany & Japan

Examples:

-

iShares MSCI Germany ETF (EWG)

-

WisdomTree Japan Hedged Equity Fund (DXJ)

Why:

Germany and Japan are poised to benefit from engineering-driven innovation. As global researchers and startups seek political and funding stability, these countries’ cultural alignment with rigor, long-term R&D investment, and regulatory transparency makes them ideal refuges.

4. European or Global Venture Capital Indexes (Private Markets)

Examples:

-

Cambridge Associates Global Venture Index

-

Moonfare European Growth Fund (for eligible investors)

Why:

If academic entrepreneurs and lab-based ventures can’t launch in Boston or Palo Alto, they will do so in Berlin, Paris, or Singapore. Private capital will follow them. Early access to first-round deep tech, especially in biotech and AI, will be rewarded in non-U.S. ecosystems.

5. Green Transition & Climate Science Funds

Examples:

-

iShares Global Clean Energy ETF (ICLN)

-

Pictet Global Environmental Opportunities Fund

Why:

Fields like climate science are under direct ideological attack in the U.S. That makes them even more valuable elsewhere. Europe and Canada, in particular, are absorbing these researchers and building real science-policy bridges. Climate-forward innovation = long-term alpha.

Strategic Takeaway

These investment opportunities arise not from hype but from systemic trust redistribution. When the U.S. no longer acts as the trustworthy steward of science, capital, talent, and innovation will flow elsewhere—first gradually, then suddenly.

1-Year Forecast For Top 3 Science Opportunity Funds

Here is a 12-month outlook for the top three funds positioned to benefit from the U.S. science brain drain:

-

IEUR (Europe): Poised for a 6% gain as public R&D investments absorb elite global talent.

-

KGRO (China): Forecasted for a 5% rise due to aggressive STEM hiring and favorable valuations.

-

EWG (Germany): Expected to grow 4% on the back of redirected industrial R&D and stable innovation ecosystems.

These projections reflect trust realignment as a capital signal—not just a cultural shift

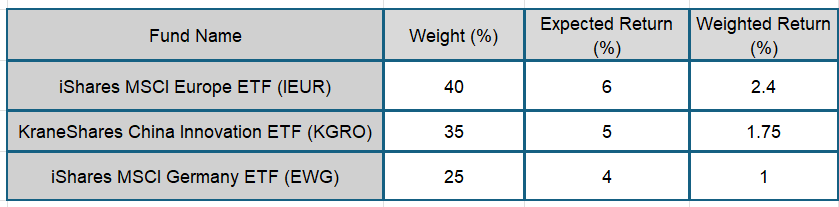

Blended Science Opportunity Portfolio

Here is an example of a blended portfolio model based on the top three science opportunity funds:

-

40% in IEUR (Europe)

-

35% in KGRO (China)

-

25% in EWG (Germany)

📈 Projected 12-month portfolio return: 5.15%

This model balances geographic diversification with science sector tailwinds, aiming to capture upside from global trust realignment while managing risk exposure.

SUMMARY

In the end, the U.S. science brain drain is more than a personnel issue—it's a global trust event. As faith in academic freedom and institutional stability erodes, the world is rebalancing. Talent migrates. Capital follows. And new innovation centers rise where trust in inquiry remains intact. For investors and advisors, this isn't just a policy ripple—it's a market signal. Those who read the trust maps early will capture the future’s value before it’s priced in.

© Copyright OPTIMAL TRUST