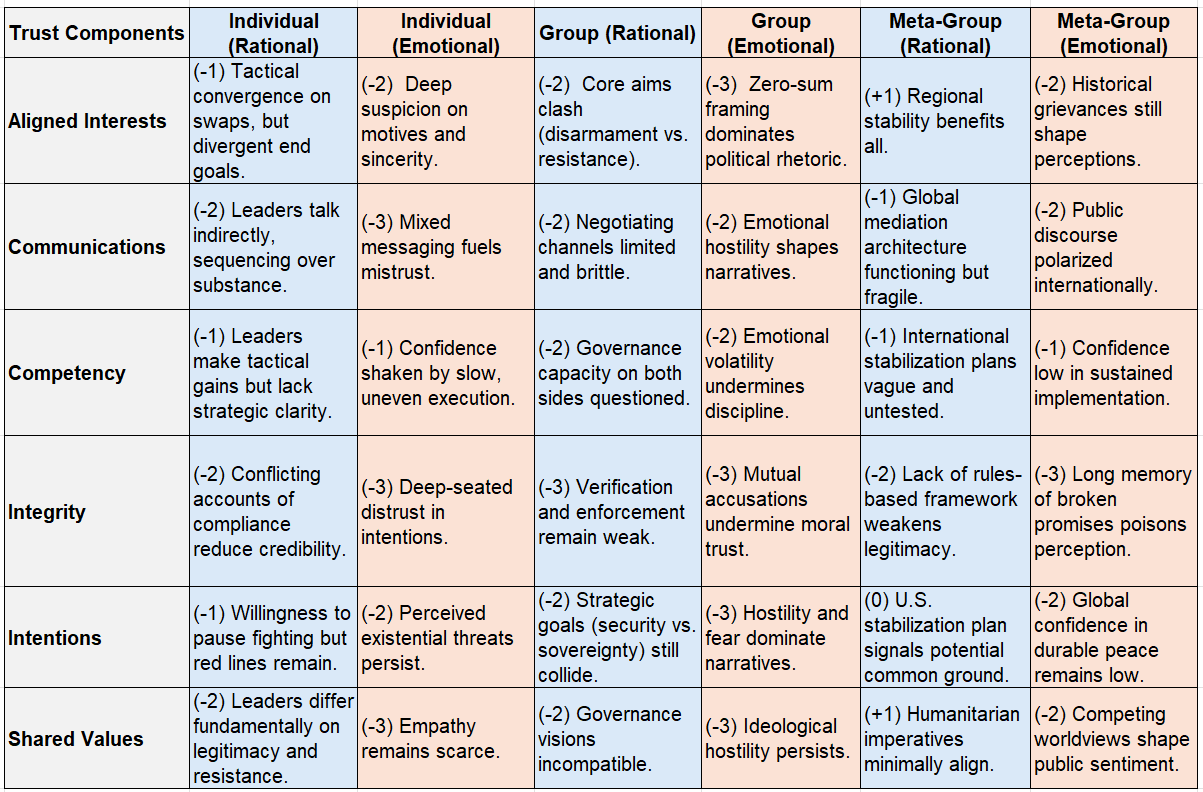

Optimal Trust Analysis:

Israel–Hamas Conflict Trust Grid

October 13, 2025

Gaza: Cease-fire holds—barely. Mediators narrow the scope to get swaps done first.

Qatar’s prime minister says mediators deliberately punted the hard stuff—Hamas’ weapons and Gaza’s governance—to push through a cease-fire + full hostage–prisoner exchange now, because neither side was ready for a grand bargain. (The Straits Times)

What’s actually happening (this week)

-

Cease-fire is in effect, but both sides are trading violation claims. Core friction: the pace and completeness of returning the remains of hostages; Israel says Hamas is holding back, Hamas says war damage makes recovery slow. (Reuters)

-

Hostage–prisoner exchanges are moving, part of a first-phase package endorsed by Washington, Doha, Cairo, and Ankara. Aid is still constrained; famine warnings persist as Rafah reopening lags. (AP News)

-

The U.S. plan’s next steps foreground a temporary International Stabilization Force tied to staged IDF withdrawals and training of Palestinian policing—still conceptual, not deployed. (Wikipedia)

-

Doha’s message: Hamas is open to discuss “not posing a threat to Israel,” but disarmament details and “who gets the weapons” were deferred to later talks. (The Straits Times)

Optimal Trust snapshot (six components × three levels)

Snapshot Observations

-

Overall Trust Climate: –1.9 (Rational) and –2.4 (Emotional) → deeply mistrustful environment, especially on emotional dimensions.

-

Best relative strength: Aligned Interests and Shared Values at the meta-group level, reflecting modest agreement on regional stability and humanitarian priorities.

-

Lowest points: Integrity and Communications at all levels — signaling that credibility, verification, and message clarity are the greatest obstacles to any durable peace.

-

Implication for strategy: Trust rebuilding must begin with transparent communication and verifiable integrity measures (e.g., monitored cease-fire compliance, third-party verification of disarmament milestones) before any deeper agreement is feasible.

Communications — Meta-group:

Mixed, often contradictory public signals (claims/counterclaims on violations; bodies timeline) sustain mistrust fog for global observers and markets. Score: Low. (Reuters)

Aligned Interests — Group:

Mediators aligned on “sequencing first, principles later.” Israel prioritizes demilitarization; Hamas prioritizes prisoner releases, aid, and space to govern. Score: Low–Moderate. (The Straits Times)

Competency — Group:

On-the-ground mechanics (body recovery, corridors, Rafah) remain fragile; logistics and verification are the chokepoints. Score: Low–Moderate. (Reuters)

Integrity — Meta-group:

Rules-based assurances are thin: accusations at the WTO-level equivalent don’t exist here, but verification gaps and reciprocal blame sap confidence in enforcement. Score: Low. (Reuters)

Intentions — Individual (leaders) / Group:

Sequencing signals pragmatic intent to bank what’s possible now; both sides still frame red lines (disarmament vs. security). Score: Mixed. (The Straits Times)

Shared Values — Meta-group:

Humanitarian imperative is the one visible overlap; security maximalism vs. resistance framing remain in tension. Score: Low. (Reuters)

What this means for advisors (translate news → moves)

1) Expect stop-start headlines.

Swaps and border steps will arrive in lumpy bursts; price action will chase each verification milestone (or lapse). Pre-plan trims/adds around announced exchange windows and Rafah status updates. (Reuters)

2) Aid + reconstruction = thematic tailwinds.

If crossings open and an ISF blueprint firms up, cement, heavy equipment, modular housing, grid repair, med-tech, and insurance/reinsurance can see incremental bid—mostly event-driven. Track for realistic timelines, not promises. (Wikipedia)

3) Energy and shipping risk premia stay sticky.

Even with guns quiet, inspection frictions and reroutes keep freight and some energy premia elevated. Transports remain headline-beta sensitive. (Reuters)

4) Client message (simple, steady):

“Peace-by-slices can work. We’re managing event risk, not betting on politics, and we’ll use scheduled milestones to adjust—not the rumor mill.” (The Straits Times)

Fast scripts for client calls (OT-aligned)

-

Frame (Communications / Meta):

“The deal was intentionally narrow to avoid collapse. That means more steps, more headlines. We plan around the steps.” (The Straits Times) -

Process (Competency / Group):

“Verification and logistics—the bodies, the crossings—drive market jitters. We’ve mapped decision points to act only when facts lock in.” (Reuters) -

Opportunity (Aligned Interests / Group):

“If the stabilization force takes form, reconstruction supply chains get real bids. We’ll phase exposure as milestones clear.” (Wikipedia)

Watchlist of near-term catalysts

-

Confirmed Rafah reopening date/time and sustained throughput. (Reuters)

-

Next hostage remains tranche; independent verification reports. (Reuters)

-

Concrete steps toward ISF mandate / contributors / ROE (rules of engagement). (Wikipedia)

- Reuters

- The Guardian

- Reuters

- The Straits Times

- AP News

T Terms of Use Disclaimer Privacy Policy Contact Us

For more info call: (347)-474-8090

Copyright 2025, All Rights Reserved

© Copyright OPTIMAL TRUST